- **TL;DR**

- How to Use This Guide

-

15 Key Workforce Analysis Metrics: The Complete Breakdown

- 1. Headcount (Actual vs Planned)

- 2. Vacancy Rate & Time-to-Fill/Time-to-Backfill

- 3. Time-to-hire price.

- 4. Cost per Hire

- 5. Quality of Hire

- 6. Turnover Rate (Voluntary and Involuntary)

- 7. Retention Rate & Distribution of Tenure

- 8.Internal Mobility & Promotion Rate

- 9. Succession Readiness & Bench Strength

- 10. Skills Coverage / Skills Gap Index

- 11. Time-to-Productivity (Ramp Time)

- 12. Spans & Layers - Span of Control

- 13. Total Cost of Workforce & Geo-Compensation Variation

- 14. Absenteeism & Overemployed/Burnout Risk

- 15. Accurate Workforce Planning, Plan Adherence

- Looking at Your Benchmark Columns

- Metrics Progression in Scheduled Business Activities

- Avoiding Blind Spots in Workforce Planning

- A better approach is to set quarterly benchmarks and plan with the expectation that your assumptions will be challenged. If your expectations are based on stale data, make your models resilient to this flaw. In your assumptions, stress-test your models with current market data.

- FAQs

**TL;DR**

The function of HR is evolving from mitigation to anticipatory action with the use of data and insights from company AI systems to forecast organizational needs at an operational level. Advanced analytics assist in tracking over 15 important indicators such as attrition, attrition-deferred promotions, retirements, internal mobility rates, and long-term evolving organizational needs, finally unlocking smarter, data-backed decisions. External market insights used in combination with internal data enable foreseeing changes, confidently planning employee needs, and skill gap resolution, thereby allowing ease in workforce planning and attainment. Streamlined talent acquisition and retention has made possible the use of market-integrating tools ensuring reduced time to hire, improved employee retention, and automation of skill gap resolution.

If you’ve ever had to sit through a meeting where someone said, “we’re hiring too slowly,” “our skills gaps keep surprising us,” or “our actuals are way off from our plans,” then you know the pain of reactive workforce management and the lack of proactive workforce analysis.

Companies that manage to scale smoothly have certainly avoided the common pitfalls that halting businesses have faced. This is all possible because the former have changed from tracking only lagging indicators to now having a pulse on leading indicators. What you really need are 15 copy-ready metrics that come with their definitions, formulas, segmentation guidelines, and benchmarks. But unlike all the other metric lists out there, this one stands out because it pairs internal HRIS and ATS data with external signals from the labor market.

To put it simply, external signals augment your basic headcount and turnover reports and turn them into valuable predictive planning tools. Safe to say these experimental metrics do not exist. These are the staple metrics that modern workforce analytics is built on, and these are the same KPIs you will come across in strategic workforce planning frameworks and ones that are monitored by high-performing talent teams and are considered table stakes.

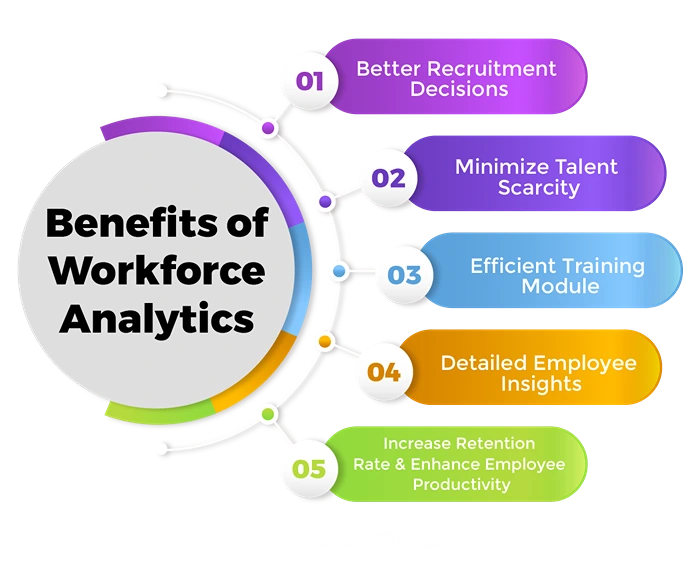

Source: Shrofile

These 15 metrics will help you make data-driven workforce decisions and will help you measure head count variance, spans and layers, eNPS, and total cost of workforce.

How to Use This Guide

1. Run core KPIs monthly for your ops review as part of ongoing workforce planning and workforce data analysis (turnover, headcount variance, TA speed and quality, absenteeism). For quarterly planning calls, prep for downstream attrition forecasts, spans and layers, succession readiness, and skills coverage. Save spike analyses for uncalibrated attrition—surges in absenteeism, unseasonable attrition, and erratic market movements.

2. Every metric listed below should be sliced by role family, critical roles, location, work type (FTE/contractor/EOR), seniority band, and diversity dimensions. A company-wide turnover rate of 15% tells you nothing if your senior engineers are leaving at 25% while customer support stays at 8%.

3. Benchmark in three tiers:

- Internal history: Your last 4-12 quarters of data.

- Peer baselines: Industry and size-comparable companies from public sources.

- External market pulse: Live labor market conditions—posting velocity, hiring difficulty, skills frequency, geographic pay differentials.

What does “good” look like?

- Plan accuracy above 90%.

- Time-to-fill in the top quartile for critical roles.

- Healthy spans and layers (7-10 direct reports, under 7 organizational levels).

- Positive employee net promoter scores, low failed-hire rates, and predictable ramp times.

These benchmarks are the best distance from reactive HR and the closest to strategic workforce planning and workforce forecasting.

15 Key Workforce Analysis Metrics: The Complete Breakdown

Source: Certified Human Resource Management Professional

1. Headcount (Actual vs Planned)

- Definition: A company’s headcount reflects the current number of employees on payroll and indicates if they are staffing Plan vs. Actual. Tracking variances keeps you on course.

- Formula: Headcount variance is calculated as (Actual Headcount ÷ Planned Headcount – 1) × 100, which gives a percentage variance.

- Why it matters: Variance of ± 3-5% signals accurate hiring as well as execution processes. Consistent cases of under-hiring stagnates growth while over-hiring accelerates cash burn.

- Segment by: Role family, location, seniority, work type.

- Benchmark: Large enterprises typically maintain ±3-5% variance to plan quarterly.

- External signal: Market demand/supply pressures hiring plans validate in the role and region. The high posting density of software engineers in Austin could rationalize a 15% under-plan in that segment.

- Pitfalls: Market constraints oversights in the original plan.

2. Vacancy Rate & Time-to-Fill/Time-to-Backfill

- Definition: Vacancy rate is calculated as open positions divided by the total approved positions. Time taken to fill the position is the number of days from requirement approval to offer acceptance. Time to backfill is the total number of days a seat is empty which includes notice time.

- Formula: Calendar days from requisition open date to offer acceptance date; vacancy percentage.

- Why it matters: Prolonged vacancies harm productivity and morale. Time-to-backfill encapsulates the comprehensive business consequences stemming from a role’s turnover.

- Fire up: Critical, non-critical roles, seniority, geographical location, and role family.

- Benchmark: For U.S., average time-to-fill is 36-44 days, furthermore, for tech roles is 40-45 days and for executive roles 65-90 days.

- External signal: Competitors’ published time-to-fill medians by occupation code and metropolitan area, coupled with competitor posting velocity serves as a warning signal for prolonged cycles.

- Pitfalls: Time-to-fill mistakenly with time-to-hire; not measuring backfill.

3. Time-to-hire price.

- Definition: Time span from application or initial candidate contact to offer acceptance. Always less than or equal to time-to-fill.

- Formula: Offer acceptance date – candidate entry date.

- Why it matters: Tracks funnel performance separately from aging requisition. Fast time-to-hire coupled with slow time-to-fill suggests issues with sourcing.

- Fire up: Hiring source, role seniority, hiring manager, location.

- Benchmark: U.S. median time 24 days; engineering median 35 days; prime candidates in 10 days.

- External signal: Reverse application-to-post ratios by sourcing funnel.

- Pitfalls: Understaffed teams and unqualified candidates skew the results.

4. Cost per Hire

- Definition: Cost per hire is the sum total costs incurred from recruitment divided by the number of hires made within the specific period.

- Formula: [(Internal recruiting costs + external spend)/number of hires]

- Components: Advertising, agency fees, assessments, signing bonuses, travel costs, recruiter’s and hiring manager’s time, and onboarding costs.

- Why it matters: The inefficiency of processes or heightened market demand could both lead to rising costs. Measure against the role importance and market context.

- Benchmark: For U.S., the average is ~ 4,700 across all roles; with tech/engineering between 6,000 and 10,000, and executive at >28,000.

- External signal: Hiring difficulty indexes provide justification for higher cost-per-hire in competitive markets.

- Pitfalls: Ignoring all cost components; overlooking quality trade-offs.

5. Quality of Hire

- Definition: Measures the performance of new hires with retention and engagement surveys along with the time it takes to achieve stated goals.

- Formula: (Performance % + Engagement % + 1-year retention %)/3

- Why it matters: Balances hiring speed with long-term success. Failed hires in the organization cost 2-3 times the annual salary in direct and indirect costs.

- Segment by: hiring manager, source, recruiter, role level

- Benchmark: 80-90% composite score 1st year attrition under 10%

- External signal: Skill-match scores of job requirements versus external market postings predict pipeline fit.

- Pitfalls: Emphasizing performances in short-term and improper records of failed hire costs.

6. Turnover Rate (Voluntary and Involuntary)

- Definition: Turnover = departures that will be back-filled. Attrition = roles business need removed.

- Formula: Total exits/average headcount over period.

- Why it matters: The cost of the voluntary turnover is between 50% and 200% (of the annual salary for the given role.) Understanding the why behind, helps form retention guides.

- Segment by: Voluntary/involuntary, reason code, role criticality, manager, tenure

- Benchmark: In 2025, the US average voluntary turnover: 13.5%, retail 24.9%, tech ~20%

- External signal: Patterns of industry resignation signal emerging flight risk hotspots.

- Pitfalls: turnover and attrition; tracking exit reason accuracy.

7. Retention Rate & Distribution of Tenure

- Definition: Typically, the retention rate is the percent measure of employees remaining after set periods of time. This distribution of tenure is measured across the organization.

- Formula: [(Headcount at the period end/headcount at the period start) × 100]

- Why it matters: It helps predict institutional knowledge risks and with planning needs. Tenure distribution shows you hiring wave patterns.

- Segment by: Role level, performance rating, location, hire source.

- Benchmark: Median U.S. tenure 3.7 years; internal movers have 53% longer tenure.

- External signal: Market tenure norms by role help set realistic retention goals.

- Pitfalls: Not accounting for business growth in retention calculations.

8.Internal Mobility & Promotion Rate

- Definition: Percentage of positions filled internally vs externally, while Promotion rate is the percentage of ripe population for promotions.

- Formula: [(Internal fills/total fills) × 100], [(Promotions/eligible population) × 100]

- Why it matters: Internal mobility always helps lower cost-per-hire for the organization, while boosting retention and capability building.

- Segment by: The applicable segments are direction (vertical, or lateral, or cross-functional), role level, diversity dimensions.

- Benchmark: Internal mobility grew from a start at 18.7% in 2021 to about 24.4% in 2023. Median promotion rate is 6%.

- External signal: Live demand peaks guide build-vs-buy decisions for critical skills.

- Pitfalls: Not tracking mobility success rates and ignoring lateral moves.

9. Succession Readiness & Bench Strength

- Definition: Ratio of critical roles with identified successors; time needed to prepare successors to the role for readiness.

- Formula: (Critical roles that have ready successors divided by total critical roles) times 100

- Why it matters: Gaps in succession create gaps which create single points of failure and costly emergency hiring.

- Segment by: Role criticality, succession timeline, development stage.

- Benchmark: Target 70% of critical roles with 1 ready successor and best-in-class achieving 100%

- External signal: Limited outside candidates for certain roles and gaps in succession depth.

- Pitfalls: Defining “ready” too generously and not adjusting as business shifts.

10. Skills Coverage / Skills Gap Index

- Definition: Proportion of critical skills with coverage versus plan, and measuring skill gaps.

- Formula: [Current skill inventory/required skill inventory x 100]

- Why it matters: These skills gaps lead to project delays, increased costs of contractors, and limits overall growth.

- Segment by: Skill criticality, business unit, geographic concentration.

- Benchmark: 60% critical skills coverage is deemed a healthy baseline.

- External signal: Skill concentration hotspots, emerging requirements, and their location in job postings.

- Pitfalls: Assuming uniformity of skills; not accounting to plan.

11. Time-to-Productivity (Ramp Time)

- Definition: Ramp time is measured as days from start date to the date a new hire starts achieving an expected level of productivity for their position.

- Formula: [ROI Start date – Productivity threshold achievement date]

- Why it matters: Gaps within onboarding processes or an inappropriate role fit for the employee can be determined, resulting in delayed ROI.

- Segment by: Onboarding experience, prior experience, role complexity, manager effectiveness.

- Benchmark: Sales roles: 90-120 days; engineering: 60-90 days. Higher and faster ramps often signal better quality-of-hire.

- External signal: Market expectations for competitor onboarding timelines derived from job postings.

- Pitfalls: Ignoring differences in role and complexity

12. Spans & Layers – Span of Control

- Definition: Number of employees directly managed by a single manager; organizational layers between the CEO and an individual contributor level employee.

- Formula: count of reporting levels in org chart; Total ICs ÷ total managers

- Why it matters: Narrow spans lead to bloat, while too wide negatively impacts management.

- Segment by: business unit, geographic region, function.

- Benchmark: 7-10 direct reports per people managers and ≤7 organizational layers are ideal for modern organizations.

- External signal: Span norms indicated by competitor job postings (“flat org,” “player-coach,”)

- Pitfalls: Functional differences and a no-coexist approach.

13. Total Cost of Workforce & Geo-Compensation Variation

- Definition: All costs associated with an employee in an organization, including: compensation, employee benefits, taxes, overhead, and geographic compensation discrepancies.

- Formula: Base + Benefits + Taxes + Overhead Allocated per FTE + geographic differential vs headquarters baseline

- Why it matters: Divisional Cost of Workforce (TCOW) determines profitability and location strategy. Geographic arbitrage opportunities counterbalance productivity and retention differences.

- Segment by: work location, role level, business unit, employment type

- Benchmark: Service organizations in the area should maintain a TCOW of 65-75% of operating expenses, while pay differentials should maintain a range of ±20-45% versus headquarters.

- External signal: Role and location compensation range analytics highlight arbitrage and competitive pressure opportunities.

- Pitfalls: productivity differences by location; all relevant cost components excluded.

14. Absenteeism & Overemployed/Burnout Risk

- Definition: Unscheduled absence rate, overtime within the absence.

- Formula: (Unscheduled absence days/scheduled work days) × 100; (OT hours ÷ regular hours) × 100

- Why it matters: High absenteeism indicates disengagement while excessive overtime indicates a high likelihood of burnout and turnover.

- Segment by: Job title, level, season, job location

- Benchmark: U.S. full-time absence average at 3.2%, best-in-class under 2%; burnout monitoring after >10% overtime.

- External signal: Industry specific spikes and seasonal demand patterns forecast capacity strain.

- Pitfalls: Not distinguishing FMLA from discretionary absence and burnout early indicators.

15. Accurate Workforce Planning, Plan Adherence

- Definition: Planned vs actual headcount, skills, cost, hiring timeline and budget adherence.

- Formula: For each dimension: (Actual – Plan)/Plan × 100.

- Why it matters: Accurate planning helps allocate resources, execute strategy, and drives business performance. Planning process failures risk consistent missed targets.

- Segment by: Business unit, role family, planning period, plan year.

- Benchmark: Leading enterprises target ≥90% plan accuracy on headcount and TCOW, reviewed quarterly.

- External signal: Scenario re-planning informed by real-time demand shocks from posting spikes or macro layoffs.

- Pitfalls: Ignoring market changes and over-planning with no revision cycles.

Looking at Your Benchmark Columns

Your metrics dashboard should display three benchmark tiers for context. Using your last 4-12 quarters of internal metrics, you have a baseline to track performance and seasonal patterns. Peer benchmarks from industry surveys and public company disclosures portray competitive position. As a side note, role and region drive massive variance. Senior ML engineers in Berlin have completely different time-to-fill than customer service reps in Dallas.

Internal data lacks context, but external signals show market trends. Live posting velocity predicts hiring difficulty long before it becomes a problem for your pipeline. Skills frequency trends show capability gaps before they can potentially hinder a project. Competitor hiring patterns indicate waning market talent supply.

Metrics Progression in Scheduled Business Activities

1. Focusing on operational metrics, Monthly Workforce Health Reviews track the business outputs: retention and turnover, headcount variance to plan, talent acquisition performance, and absenteeism and overtime. These sessions pinpoint tactical changes—enhancing manager effectiveness, filling in-demand roles, and adjusting overall capacity.

2. Quarterly reviews of the organizational design give attention to spans and layers, internal mobility trends, succession preparedness, workforce skills gaps vs strategic needs, workforce costs, and geographic compensation trends. These affect long-term organizational changes and investment priorities.

3. Scenario Planning Moments such as hiring freezes, new market entry, or new product launch fall under the category of external demand and supply signal matchmaking. These moments need fast internal recalibration. External signals or metrics tend to be faster than internal metrics especially during times of drastic change.

Avoiding Blind Spots in Workforce Planning

Company-wide averages can sometimes hide important patterns. Take general employee turnover statistics; they could conceal the exit of many engineers, just as the departure of engineers could cover up turnover in customer success teams. Fast food and call center employee performance metrics also need to be evaluated in the context of the relevant customer segment; otherwise, the conclusions made would be profoundly misleading.

Organizations that solely depend on lagging indicators in workforce data analysis are bound to miss critical blind spots. Even though past actions may be captured by internal data, predicting future events based on internal data is impossible. External signals become critical in these scenarios as they capture market shifts in real-time.

Getting the definitions correct in this case is important, such as the example below:

- Turnover and attrition are completely different concepts.

- Time to hire and time to fill are not the same and should not be treated as such.

It’s not just about cutting off a hire and marking them off. A hire who doesn’t work out incurs costs that go beyond just culture and customer satisfaction. Errors defined and paired with outdated data may fail to capture what changes, if any, need to be made to the organizational design. In a hybrid work environment, a 90-day ramp plan off of 2019 will be overshooting the mark.

A better approach is to set quarterly benchmarks and plan with the expectation that your assumptions will be challenged. If your expectations are based on stale data, make your models resilient to this flaw. In your assumptions, stress-test your models with current market data.

All Set to Change Your Workforce Planning?

The difference between proactive and reactive planning stems from a combination of internal measurements and external market evaluation. Your HRIS indicates the past trends of your workforce, whereas external signals forecast the changes and opportunities in your talent markets. These 15 metrics are fundamental for making workforce analysis and workforce planning decisions. However, they need to be paired with market context to be truly effective. The goals now are to begin monitoring and tracking, as well as segmenting, so that you can finally shift from using lagging to leading indicators.

With JobsPikr, get access to real-time analytics, including but not limited to, workforce skills gap analysis, hiring trends, and geographic pay benchmarks. Mitigate emerging talent risks, improve workforce forecasting, and adapt plans with much better precision. If you’ve been looking for workforce planning solutions or a functional way to weave external indicators into your decision-making processes, explore our solutions to pinpoint capability gaps, boost retention, and dramatically improve the time to fill critical roles.

FAQs

1. What are workforce metrics?

Workforce metrics are specific quantifiable metrics that reflect the effectiveness of people management within an organization. Examples include headcount variance, time-to-fill, turnover rates, internal mobility, skills coverage, and total workforce costs. Consistent measurement helps HR leaders conduct precise workforce analytics and identify trends, risks, and opportunities for enhanced productivity, retention, and optimal talent deployment.

2. What are the 7 R’s of workforce planning?

The 7 R’s of workforce planning form a foundational structure for the proper allocation of talent within an organization.

Right Culture – Supports employee engagement and retention.

Right People – Talent necessary for the strategy must be available.

Right Skills – Skills must be aligned with organizational needs.

Right Place – People must be placed where they can be the most impactful.

Right Time – Talent must be deployed when most necessary.

Right Cost – Budget for workforce planning must be spent effectively.

Right Structure – Efficient spans and layers for agility must be maintained.

3. What is HR metrics and workforce analysis?

Productivity measures like turnover rate, absenteeism, and cost per hire are examples of HR Metrics. These metrics are useful during the assessment of HR processes and their effectiveness. As for workforce analysis, it is the combination of internal HR metrics and external labor market indicators analyzing deeper market trends to acquire insights regarding the available and in-demand talent, including the existing skills gaps. Thus, combined with HR metrics, workforce analysis offers deeper insights, assisting organizations in rational and informed workforce planning.

4. What is KPI in the workforce?

In the workforce, KPI stands for key performance indicator which is defined as a measurable value that shows the performance of a set business objective or talent objective. Within workforce analytics, common KPIs are time to fill a vacant position, employee net promoter score (eNPS), internal promotion rate, and metrics that assess the workforce skills gap. With the help of KPIs, complex workforce data is simplified and thus becomes far more accessible and actionable for organizational leaders.