- What is Industry Benchmarking?

- **TL;DR**

- How Benchmarking Started and Why It Stalled

- Core Methods of Industry Benchmarking

- The Data Problem: Why Traditional Benchmarking Falls Short

- Want to see how your talent strategy compares to the market right now?

- Real-Time Benchmarking: The Modern Alternative

- The Pitfalls of Benchmarking (and How to Avoid Them)

- How Real-Time Workforce Intelligence Solves These

- Real-Time Benchmarking in Action: JobsPikr’s Role

- The Future of Industry Benchmarking

- Want to see how your talent strategy compares to the market right now?

- Frequently Asked Questions

What is Industry Benchmarking?

**TL;DR**

Industry benchmarking is about knowing where your business stands, whether you’re outperforming competitors or lagging. The problem? Most benchmarking still relies on slow, survey-based data that’s outdated by the time it reaches you. Real-time labor market analytics change that. Instead of waiting for annual reports, you can now see how your hiring pace, pay ranges, or skill mix compares to others right now. It’s the difference between steering with last year’s map and navigating with a live GPS.

Forget the buzzword for a minute. Industry benchmarking simply means checking how your company stacks up against others doing the same thing. Are your costs higher? Are your people more productive? Are your salaries competitive? That’s all benchmarking tries to answer: a clear look at where you stand and what needs work.

The idea isn’t new. For decades, businesses have compared themselves to peers to find gaps and improve. Manufacturers compared defect rates. Retailers compared inventory turnover. HR teams compared hiring timelines. But the process itself has barely evolved; most companies still depend on PDF reports and static surveys that summarize last year’s data.

And that’s the real issue. Benchmarking, when it’s late, loses its edge. By the time the numbers are published, the market has already moved. Salaries shift. Roles change. Competitors tweak their org structures. Acting on those delayed benchmarks is like running your business in slow motion.

Today, workforce intelligence tools and labor market analytics flip that equation. Instead of looking backward, they stream live data from millions of job postings and company updates to show how the industry is shifting right now, from pay transparency trends to hiring velocity and emerging roles.

That’s not just a faster way to benchmark. It’s a smarter way to stay ahead.

How Benchmarking Started and Why It Stalled

Benchmarking idn’t begin in boardrooms or tech dashboards. It started decades ago on factory dfloors. The goal was simple: find out how competitors build things faster, cheaper, or better and borrow the idea.

The earliest adopters were manufacturers. They compared production times, waste ratios, and output quality to set internal performance targets. Over time, the concept spread everywhere, marketing teams started benchmarking ad spend, HR benchmarked employee turnover, and finance benchmarked cost structures. It became the corporate version of “how are we doing compared to everyone else?”

But while the idea evolved, the method didn’t.

For years, benchmarking meant filling out long surveys, submitting spreadsheets to consultants, and waiting months for industry reports. The final result would arrive in a polished PDF, filled with averages that looked reliable but were already outdated. By the time those reports hit your desk, new competitors had entered the market, salary bands had shifted, and your benchmark had quietly expired.

A 2023 SHRM survey found that many HR leaders say their benchmarking data is already outdated by the time they act on it. Three months may not sound like much, but in today’s job market, it’s a lifetime.

The problem isn’t benchmarking itself; it’s the data refresh cadence. Traditional benchmarking works in slow cycles, while modern business moves daily.

So, while benchmarking started as a tool for operational excellence, it’s now bumping against the limits of static data. You can’t fix today’s challenges with yesterday’s insights.

That’s why companies are shifting toward live data sources, where insights refresh automatically and decisions keep pace with the real world.

Benchmarking Data Playbook: Real-Time Workforce Metrics That Matter

Core Methods of Industry Benchmarking

There’s no single way to benchmark. Different teams benchmark different things — performance, processes, or even strategy. But all of it boils down to one question: how do we compare to everyone else doing this right now?

Here are the most common forms of benchmarking and how each one actually works in practice.

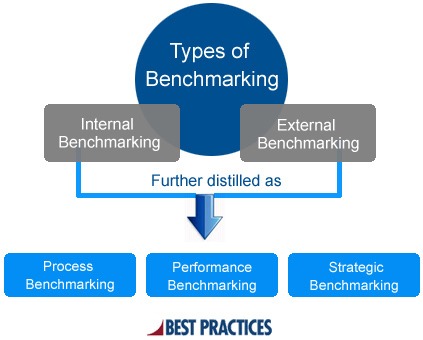

Image Source: Best-In-Class

1. Performance Benchmarking

This is the most familiar type, the one everyone starts with. Performance benchmarking means comparing measurable outcomes: sales per employee, cost per hire, profit margin, or customer satisfaction scores.

Think of it like running a race. You might feel fast, but until you see the others’ times, you don’t really know how you performed. That’s what performance benchmarking does, it gives context to your numbers.

For example, if your team fills open roles in 40 days and the industry average is 60, that’s a competitive edge worth protecting. But if everyone else is doing it in 25, you’ve got a process slowdown disguised as “normal.”

The trick is choosing metrics that actually matter to your business, not vanity numbers that look good on slides.

2. Process Benchmarking

Performance tells what happens; process benchmarking explains why.

Here, the focus shifts from results to how work gets done. It’s about studying workflows, not just outcomes, things like recruitment funnel efficiency, candidate conversion rates, or onboarding time.

Take hiring again: two companies might fill roles in the same time frame, but one uses automated screening and structured interviews, while the other still filters resumes manually. The performance looks equal, but the process isn’t.

Process benchmarking helps leaders uncover those operational inefficiencies that hide behind surface-level metrics.

3. Strategic Benchmarking

This one zooms out. Instead of comparing numbers or workflows, strategic benchmarking looks at how organizations position themselves.

It’s about long-term direction, market expansion, workforce planning, or how you build resilience during disruption. For example, if peers are shifting toward hybrid work models or reskilling initiatives and you’re not, that’s a strategic gap.

Strategic benchmarking uses workforce intelligence data to read the bigger signals: which industries are hiring aggressively, which roles are declining, and what skills are being phased out. It’s less about fixing processes and more about future-proofing decisions.

4. Talent and Compensation Benchmarking

This is where things get personal, literally. Talent benchmarking compares how your people strategy stacks up against the market. It includes pay scales, benefits, skills demand, and job roles.

In a tight labor market, this is gold. If your pay range for data engineers sits 15% below the market median, you’ll struggle to attract (and keep) top talent. Likewise, if your competitors are hiring for new roles, like “AI operations manager”, and you haven’t even listed it in your org plan, you’re already behind.

This is where labor market analytics and tools like JobsPikr shine. They scrape and aggregate millions of job postings to show real-time demand patterns, helping you benchmark salaries, skills, and hiring velocity without relying on last year’s compensation reports.

Each of these benchmarking types feeds into the next. You start by measuring performance, then explore how processes cause those results, align them with strategy, and finally, benchmark the people who make it all happen.

But even with all that structure, there’s a catch: most of it still runs on slow, static data. And that’s the gap modern businesses are trying to close.

The Data Problem: Why Traditional Benchmarking Falls Short

On paper, benchmarking sounds foolproof: gather data, compare numbers, make decisions. But in reality, most benchmarking fails not because the concept is wrong, but because the data behind it is stale, incomplete, or too generic to act on.

Let’s start with the biggest issue: data latency.

Most traditional benchmarking runs on annual or semi-annual surveys. Consultants send questionnaires, companies respond, analysts compile the results, and months later, a “fresh” industry report lands on your desk. Except by then, the market has already changed.

Hiring rates fluctuate weekly. Salary trends shift monthly. Skill demands evolve overnight. A benchmark that was accurate in January can be irrelevant by July.

According to a 2023 SHRM study, over 70% of HR leaders say their benchmarking data is outdated by the time they use it. That’s the cost of slow refresh cadence, decisions based on yesterday’s reality.

Another problem? Data uniformity. Traditional benchmarking assumes one-size-fits-all comparisons. But not every “retail company” or “software firm” operates the same way. Comparing your metrics to a mismatched peer set can distort your entire strategy.

Then there’s reporting bias, companies self-report data differently. Some round up numbers, others underreport, and a few skip categories altogether. What looks like a clean chart often hides inconsistent inputs.

Put simply, static benchmarking offers a snapshot, not a signal. It tells you what happened, but not what’s happening.

This is where real-time labor market analytics fill the gap. Instead of waiting for survey cycles, you pull live data from job postings, hiring announcements, and skill trends to see market changes as they occur. No waiting for the next edition. No guessing if your numbers are outdated.

When companies base workforce planning on live benchmarks, they don’t just react faster — they make fewer mistakes. It’s the difference between checking last season’s weather forecast and reading the radar before stepping out.

Want to see how your talent strategy compares to the market right now?

Schedule a Demo to explore how JobsPikr delivers live, actionable benchmarks for smarter workforce decisions.

Real-Time Benchmarking: The Modern Alternative

If traditional benchmarking is a snapshot, real-time benchmarking is a live feed. Instead of relying on quarterly or annual data, it taps into live signals from across the web — job postings, company announcements, hiring trends, and salary ranges — to show you how the market is shifting today, not last month.

This shift isn’t just about speed; it’s about accuracy. Real-time data lets you benchmark continuously, track movement as it happens, and respond before competitors do.

From Static Surveys to Dynamic Feeds

In the old world, benchmarking meant paying for a PDF full of aggregated numbers that were already outdated. Now, you can plug into dynamic data feeds that refresh daily.

Imagine you’re an operations manager trying to understand why your hiring costs suddenly spiked. A static benchmark tells you that “average cost per hire” in your industry is $4,700 — data pulled six months ago. Helpful, maybe. But what if salaries for data analysts jumped 12% in just the last 60 days?

That’s the problem with static data: it smooths over volatility. Real-time benchmarking captures it.

By tracking live job postings and skill demand through labor market analytics, you can see shifts in pay bands, hiring velocity, and even emerging job titles before the rest of the market catches on.

The payoff? You move from reacting to anticipating.

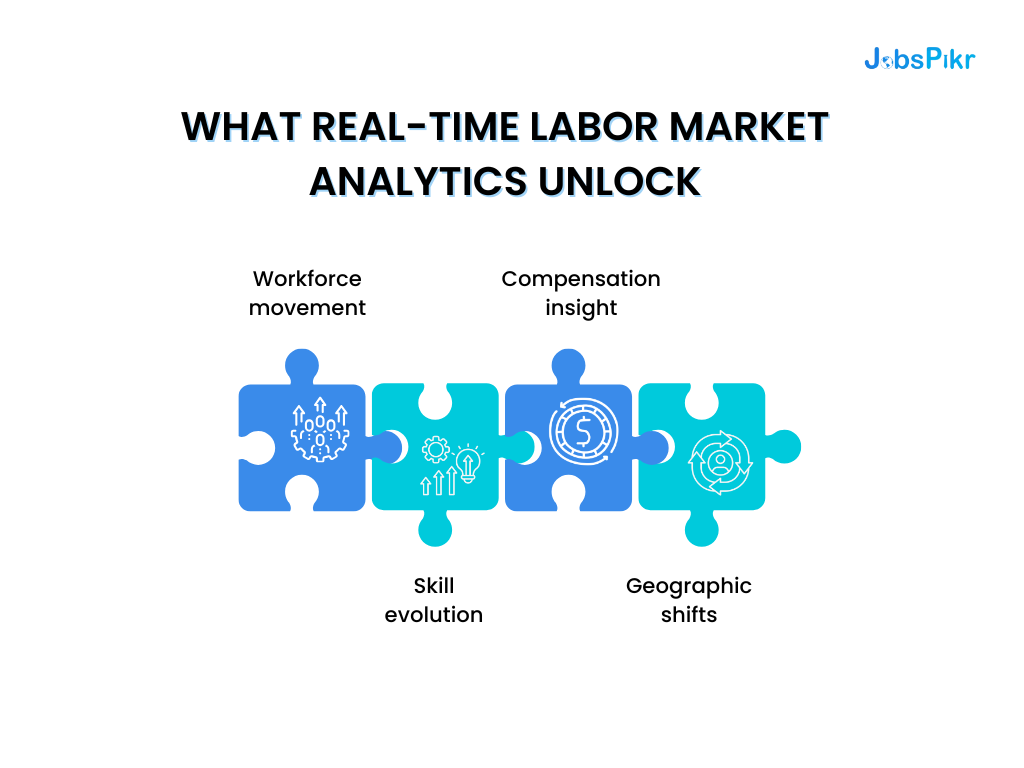

What Real-Time Labor Market Analytics Unlock

Real-time benchmarking opens the door to a different level of visibility:

- Workforce movement: You can see which competitors are ramping up hiring or quietly slowing down. That’s early intelligence on who’s growing and who’s struggling.

- Skill evolution: New roles appear, old ones vanish. With live job data, you can spot emerging skill clusters like the rise of “prompt engineers” or “AI safety leads” and align your talent strategy before the rest of your industry adjusts.

- Compensation insight: Instead of relying on self-reported salary surveys, you see what companies are actually offering in their listings. That’s how you benchmark real pay, not theoretical pay.

- Geographic shifts: Hybrid work has redrawn talent maps. Real-time data shows where roles are moving, where pay premiums are rising, and which cities are losing relevance.

This kind of benchmarking turns static metrics into living intelligence. It gives business leaders, especially in SMBs, the same agility large enterprises get from costly consulting reports, without the lag or overhead.

A Quick Example: Benchmarking in Motion

Let’s say a mid-sized tech firm in Bangalore wants to expand its data team. The HR head looks at last year’s salary survey and sees that senior data analysts earn ₹18–20 lakh annually. But when she checks live job postings through a labor market analytics platform, the average offer in Q4 has jumped to ₹24 lakh — with added benefits and hybrid options.

That’s a 20% increase missed entirely by static benchmarking.

By acting on live benchmarks, she can adjust budgets, reframe offers, and stay competitive, all before the next annual report even acknowledges the shift.

That’s what makes real-time benchmarking so valuable: it collapses the gap between observation and action.

When the market changes faster than your data refreshes, you lose ground. Real-time benchmarking helps you keep pace not by predicting the future, but by catching it early enough to make better moves.

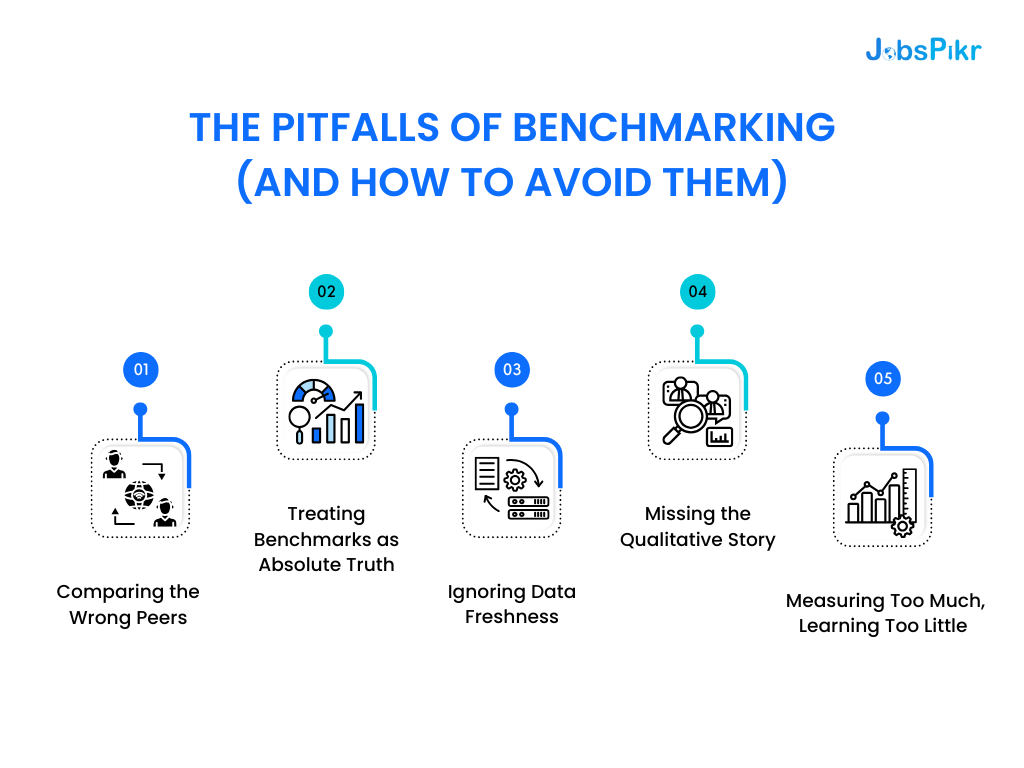

The Pitfalls of Benchmarking (and How to Avoid Them)

Benchmarking can sharpen your decisions, or completely derail them, depending on how you do it. Most teams get the concept right but stumble in execution. They chase neat comparisons, pull mismatched data, or treat benchmarks as absolute truth instead of a directional guide.

Let’s unpack the most common pitfalls and how to steer clear of them.

1. Comparing the Wrong Peers

This is where many benchmarking projects start off-track. A mid-sized SaaS company comparing itself to global tech giants will always look underperforming on hiring, salaries, or retention. The scale is off, so the insights don’t hold up.

The key is relevance. Pick peers that mirror your company’s size, region, and maturity. A fair peer comparison makes the data meaningful. A lazy one just makes you look small.

2. Treating Benchmarks as Absolute Truth

A benchmark is a guide, not a gospel. Too often, leaders cling to “industry average” as if it’s the finish line. The problem? Averages hide the spread. They blur out context, business models, growth stages, or competitive pressure.

If your turnover rate is 10% higher than the industry average, it might signal trouble. Or it might just reflect a fast-scaling team with aggressive hiring goals. Without context, numbers mislead.

3. Ignoring Data Freshness

We’ve said it before, but it bears repeating — benchmarking loses value when your refresh cadence is slow. Data that’s three months old may as well be a year behind in volatile labor markets.

That’s why real-time benchmarking is gaining traction. You can’t wait for the next report when competitors are adjusting pay scales or job titles every week. Freshness isn’t a luxury anymore — it’s survival.

4. Missing the Qualitative Story

Numbers tell you what’s happening, but not why. If your time-to-hire is double the benchmark, that stat alone doesn’t reveal whether it’s due to process bottlenecks, reputation issues, or location constraints. Pair every metric with context — internal surveys, exit interviews, and candidate feedback.

Good benchmarking combines data and narrative. It’s not about copying competitors; it’s about understanding what drives the difference.

5. Measuring Too Much, Learning Too Little

When teams benchmark everything, nothing stands out. The best companies focus on a handful of metrics tied to outcomes that actually matter — productivity, cost per hire, retention, pay competitiveness. Benchmarking 40 different KPIs won’t make you smarter; it’ll just drown you in noise.

How Real-Time Workforce Intelligence Solves These

Live benchmarking flips these problems on their head. Instead of static averages, you get dynamic ranges — real salary bands, live job volumes, and skill demand that shift with the market. You don’t compare yourself to one broad “industry”; you filter peers by geography, scale, and tech stack.

And because the data refreshes continuously, you’re not stuck planning next quarter’s strategy with last quarter’s numbers.

In short, traditional benchmarking gives you reflection. Real-time workforce intelligence gives you direction.

Benchmarking Data Playbook: Real-Time Workforce Metrics That Matter

Real-Time Benchmarking in Action: JobsPikr’s Role

At some point, every company realizes that the hardest part of benchmarking isn’t the math — it’s the data. Getting accurate, up-to-date, and comparable numbers across industries, roles, and regions takes time and tools most SMBs don’t have.

That’s exactly where JobsPikr steps in.

JobsPikr pulls job postings, titles, salaries, and skill data from thousands of sources worldwide. It then cleans, categorizes, and standardizes all that information to build real-time labor market analytics — data you can actually use for workforce and salary benchmarking.

In practice, this means you can do in minutes what once took months of research and reporting.

How It Works in the Real World

Say you’re a mid-sized logistics company trying to benchmark warehouse manager salaries across India. Traditional benchmarking would send you to a consultant, a few industry PDFs, and maybe a government report that’s two years old.

With JobsPikr, you could instantly see:

- The current average salary for warehouse managers across metros vs. Tier-2 cities.

- Which companies are hiring most aggressively in that role right now.

- How job descriptions are evolving — are they asking for automation experience, data familiarity, or AI tools?

- How your open roles compare in real time on pay, skills, and seniority.

That’s not a static comparison; it’s active market sensing. You see what’s happening, where it’s happening, and what that means for your next move.

This is benchmarking with real refresh cadence — data that updates automatically as the market shifts.

Why Real-Time Matters More Than Ever

Industries change fast. Hiring slows in one region and spikes in another. Entire roles appear overnight (remember when “data engineer” barely existed a decade ago?). You can’t afford to run your workforce planning on last year’s snapshots.

JobsPikr bridges that gap. It delivers workforce intelligence you can plug directly into dashboards, reports, or analytics tools, no manual cleanup, no waiting for consultants.

The result? You get benchmarks that breathe.

- Benchmarks that tell you how competitors are hiring right now.

- Benchmarks that show which skills are surging in your market.

- Benchmarks that adapt to shifts in pay transparency laws or talent migration trends.

That’s what makes JobsPikr a real-time alternative to traditional benchmarking — it turns market signals into decisions you can act on today, not next quarter.

The Future of Industry Benchmarking

Benchmarking used to be backward-looking — a way to understand how you did. But that mindset doesn’t cut it anymore. Business conditions shift too fast, labor markets evolve overnight, and job roles transform before your next annual report even lands in your inbox.

The future of benchmarking isn’t about reflection. It’s about anticipation.

As industries digitize, benchmark data will no longer come from surveys or consulting firms. It will come from real-time labor market analytics, streaming directly from the open web. The refresh cadence will move from quarterly to continuous. Benchmarks won’t be static numbers you reference once a year — they’ll become live indicators that update automatically, the way stock tickers do for financial markets.

And that’s where tools like JobsPikr set the tone for what’s next.

Imagine being able to see workforce movements across your sector — in real time. Watching hiring surges as they happen. Adjusting your compensation strategy before attrition hits. That’s where benchmarking is headed: from a lagging indicator to a live competitive signal.

For operations managers and SMB leaders, this shift is huge. It means decisions don’t have to wait for the next “industry report.” They can happen instantly, powered by verified, clean, and current data.

The companies that win won’t just compare better — they’ll react faster.

In the next few years, benchmarking will move from being a mirror to being a radar — not something that shows where you’ve been, but something that helps you steer where you’re going.

Want to see how your talent strategy compares to the market right now?

Schedule a Demo to explore how JobsPikr delivers live, actionable benchmarks for smarter workforce decisions.

Frequently Asked Questions

1. What is industry benchmarking?

Industry benchmarking is the process of comparing your company’s performance, workforce metrics, or business practices with others in your industry. It helps you understand where you stand — whether you’re outperforming, matching, or lagging behind peers. Modern benchmarking uses labor market analytics to make these comparisons faster and more accurate, replacing slow survey cycles with live data from job postings and company updates.

2. What are the main types of benchmarking?

There are four key types of benchmarking:

Performance benchmarking compares measurable results like revenue per employee or cost per hire.

Process benchmarking looks at how workflows operate internally.

Strategic benchmarking examines business direction and competitive positioning.

Talent and compensation benchmarking focuses on pay, skills, and workforce trends.

Each type serves a different purpose, but together, they offer a 360-degree view of your company’s competitive standing.

3. Why is traditional benchmarking often inaccurate?

Traditional benchmarking relies on static, survey-based data that takes months to collect and publish. By the time leaders receive those reports, market conditions have already shifted. This data latency means you’re comparing your current state to last quarter’s market — not today’s. Real-time workforce intelligence eliminates this lag by updating continuously as the market changes.

4. How can real-time labor market analytics improve benchmarking?

Real-time analytics use live data — job postings, pay ranges, skills, and hiring volumes — to deliver up-to-date insights. Instead of reacting to outdated averages, you can spot new roles, shifting salaries, or emerging skill gaps as they happen. This makes benchmarking predictive rather than reactive, giving you the ability to make immediate, informed adjustments to your hiring or pay strategies.

5. How often should companies update their benchmarks?

In fast-changing labor markets, annual or quarterly updates aren’t enough. Benchmarks should refresh weekly — ideally, automatically. Tools like JobsPikr handle that for you by continuously monitoring the web for workforce trends and salary changes, ensuring your benchmarks never fall behind.