The process of merging companies or acquiring new ones (known as M&As) can significantly alter industry competition. However, a frequently neglected aspect is ensuring the compatibility of human resources within these transactions. Talent intelligence plays a pivotal role here, enabling companies to make informed decisions by:

- Assessing cultural fit and leadership qualities.

- Mapping competency frameworks to identify talent synergies and gaps.

- Predicting workforce integration challenges and opportunities.

- Leveraging data-driven insights for strategic talent planning.

In the M&A context, deploying talent intelligence can dramatically increase the likelihood of a smooth transition and long-term success.

Laying the Groundwork: Pre-Merger Talent Assessment

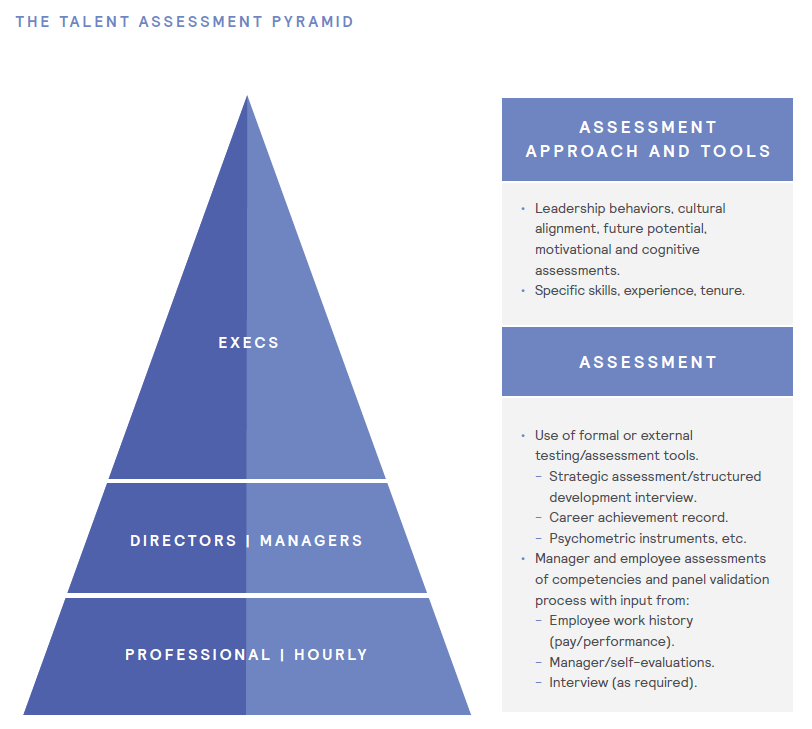

Image Source: https://www.marshmclennan.com/insights/publications/2020/november/deep-dive–talent-assessment-in-m-a.html

In advance of any proposed mergers or acquisitions, we strongly recommend undertaking an exhaustive appraisal of available talent within the respective organizations. Such an evaluation would entail a comprehensive analysis of the inherent strengths, limitations, as well as future prospects of extant personnel across both entities. By doing so, we can effectively align strategic objectives while ensuring optimal utilization of our collective human capital resources.

Elements to focus on include:

- Skills inventory

- Performance metrics

- Leadership qualities

- Cultural fit

Understanding these factors informs decision-making and helps in preserving valuable talent post-merger. This groundwork prepares for a smoother integration and strategic talent deployment, ensuring the merged entity operates efficiently from the outset.

The Strategic Value of Talent Data in M&A Decision-Making

In mergers and acquisitions (M&A), talent data provides a strategic advantage by enabling better decision-making. Here’s how:

- Assessment of Compatibility: Job data allows companies to evaluate the workforce compatibility of potential M&A targets. Compatibility is crucial to ensure a smooth transition and integration post-acquisition.

- Retention of Top Performers: Understanding the talent landscape aids in identifying and retaining key performers who are critical to the organization’s future success.

- Cultural Alignment: Through talent data analysis, companies can assess cultural fit, which is essential for maintaining employee morale and productivity during M&A processes.

- Strategic Positioning: Talent intelligence provides insights into skills and capabilities, allowing firms to align acquisitions with their long-term strategic goals.

Utilizing talent data reduces risks and boosts the synergy results of M&A endeavors.

Overcoming Cultural and Operational Barriers to Talent Integration

In the dynamic terrain of M&A, the seamless integration of talent is often impeded by cultural and operational hurdles. Enterprises must steer this landscape thoughtfully:

- Initiate dialogues to understand the diverse cultural backgrounds of the merged entities.

- Create inclusive frameworks that harmonize different operational practices.

- Design cross-cultural teams to champion integration, facilitating information exchange and mutual respect.

- Invest in training programs tailored to address the nuances of both organizational cultures.

- Empower leadership to navigate and mitigate conflicts, promoting a united, collaborative environment.

Through these proactive measures, companies can reconstruct barriers into bridges, paving the way for a cohesive and effective talent amalgamation.

Leveraging Technology for Efficient Talent Merging

When it comes to modern business, which moves at an incredible speed, technology has become indispensable for successfully integrating talent during mergers and acquisitions. Through the use of cutting-edge algorithms and artificial intelligence, organizations can evaluate vast quantities of data to determine the compatibility of different talent pools and deepen their comprehension of possible synergies. These technologies empower:

- Detailed talent assessments, highlighting areas of strength, redundancy, and potential cultural clashes.

- Predictive analytics to forecast integration challenges and successes, allowing for proactive management.

- Social network analysis tools to uncover hidden employee relationships and influence dynamics.

- Centralized digital platforms that streamline communication and maintain engagement during transitional periods.

- Virtual collaboration tools that facilitate cross-team introductions and project test-runs before full integration.

By utilizing these technological tools, organizations can achieve a smoother and more strategic talent merging process.

Best Practices for Retaining Key Employees During M&A Transactions

- Communicate Transparently: Keep key employees informed about the transaction’s progress and future plans, alleviating uncertainty and rumors.

- Offer Incentives: Provide financial rewards, such as retention bonuses or stock options, to encourage key talent to stay.

- Create a Career Path: Outline clear career progression opportunities within the new entity to assuage fears of redundancy.

- Involve Them in Planning: Engage critical staff in the M&A planning process, giving them a sense of ownership and control.

- Prioritize Culture Fit: Ensure cultural alignment during the merger to maintain morale and reduce the risk of attrition.

- Provide Support Systems: Offer counseling, mentorship, or training to help employees adapt to changes post-merger.

Measuring the Success of Talent Integration in M&A

When it comes to mergers & acquisitions (M&A)the effectiveness of talent integration stands as a pivotal element, significantly influencing the ultimate result of the transaction. Firms need to evaluate talent integration’s efficacy through various essential performance metrics (KPIs):

- Retention rates post-merger, tracking how many acquired employees stay with the company over time.

- Employee satisfaction scores, gathered through surveys to gauge morale and engagement levels.

- Cultural alignment, evaluated through feedback and observation of integration with existing teams.

- Performance metrics, analyzing the productivity and contributions of new talent within the merged entity.

- Leadership assimilation, observing how acquired leaders integrate and influence the company’s direction.

Effective measurement and monitoring of these KPIs provide a clear view of talent integration success and illuminate areas for improvement in future M&A activity.

Predictive Analytics and the Future of Talent Intelligence in M&A

As the mergers and acquisitions landscape undergoes change, predictive analytics emerges as a crucial asset in talent intelligence. Corporations recognize significant advantages in utilizing predictive models to evaluate potential cultural and talent alignments prior to completing M&A transactions. These future-oriented analytics can provide:

- Strategic Insights: By pinpointing personnel strengths and forecasting future success, firms can make data-driven decisions.

- Risk Mitigation: Predictive tools can anticipate talent conflicts and integration issues, enabling pre-emptive solutions.

- Retention Strategies: Leveraging predictions on employee turnover, companies can implement measures to retain key talents.

- Cultural Alignment: Analyzing projected cultural fit can aid in smoothing transitions and blending workforce ideologies after mergers.

Thus, as firms integrate predictive analytics into talent intelligence, they pioneer a more strategic and successful M&A landscape.

Conclusion

In the intricate theater of mergers and acquisitions, talent intelligence emerges as a pivotal player. It enables organizations to make data-driven decisions about human capital, fueling strategic moves that can decidedly affect the outcome of an M&A.

By leveraging analytical insights into workforce competencies, cultural alignment, and future potential, companies positioned at the forefront of talent intelligence are not merely surviving but thriving amidst the complexities of M&A activities. Thus, talent intelligence is not an optional tool; it is an indispensable asset that can spell the difference between a merger’s success and failure.