**TL;DR**

- Workforce planning is leaving static headcount reports behind, giving way to predictive, skill-driven models that analytics now fully power.

- By early 2025, predictive and analytical capabilities will have reached 80% of HR organizations; yet only a slice, 32% today, have adopted such forecasting, revealing a looming and profitable gap still to be claimed.

- First-wavers achieved $13.01 in return per dollar spent and reported quarter-on-quarter productivity lifts of 25% alongside a 50% drop in attrition, all traceable to early predictive applications.

- Notably, job market indicators like hiring pace, in-demand skills, and evolving salary bands reveal their signals two to three months sooner than classic internal HR cycles, making these market-derived data points critical.

- Platforms like JobsPikr scan 275 million job postings globally in real time and freeze this data into 195 local contexts, yielding the granularity needed for harmonized analytics.

- A comprehensive measurement framework weaves together leading measures such as hiring speed, skills-flare maps, and compensation gradients, along with internal talent supply shadows like coverage of key skills, bench depth, and internal mobility coupled with attrition and engagement risks.

- Artificial intelligence, digital organization models, and prescriptive analytics together reorient workforce planning from a retrospective function into a suite of scenario-driven decisions.

- Organizations that seize the moment now stand to sharpen forecasting precision, cut planning costs, elevate talent retention, and steer ahead of the swiftly shifting labor landscape.

Counting heads and filling empty chairs got us this far, but it won’t take us any farther. As we head toward 2025, the winners will be the ones who train their eyes to see hidden patterns across the world’s job markets, patterns that flash in plain sight when the proper lenses are worn.

Research shows industrial momentum: 80% of firms will infuse AI into HR operations by late 2025, and 70% already treat workforce analytics as their top agenda, a stunning leap from 30% in 2016. Yet a mere 32% use workforce planning and analytics. This shortfall isn’t merely a number. It is both a gateway to unprecedented upside and an urgent alarm bell. The time to cross the divide has shrunk to a heartbeat. Early adopters already bank stunning dividends.

For every dollar invested in workforce planning metrics, the average chief financial officer sees $13.01 returned. Employee productivity swells by a quarter, and predictive modeling slashes attrition by half. The recipe is straightforward but disciplined: merge deep internal data sets with buzzing, live external job market signals, and deploy the nuggets across every relevant workforce planning metric. Scale follows insight, and money follows scale.

The Great Transition: From Reactive Reporting to Predictive Planning

Today’s workforce analytics landscape is separated by a widening chasm. Legacy firms still navigate by staring through the rear windshield—they grasp past events but remain blind to future shifts. An astonishing 80% of their analytics hours go to hunting down fragmented data stores, and still, the end product rarely moves beyond static tables. The predominant metric is simple descriptive analytics: chronicling hiring velocity and plotting attrition curves. Picture a meteorologist confined to archival maps, incapable of projecting next week’s storm intensity; that’s the analytic value they deliver.

Meanwhile, forward-looking enterprises have completely revamped their workforce planning tools. The emphasis has moved from hoarding data to conducting informed, timely analysis, trimming data-collection cycles to only 40%. A noteworthy 85% of these firms now harmonize data from HRIS, ATS, learning apps, and, importantly, external job ads. The payoff is a seismic boost in workforce planning accuracy. Mean Absolute Percentage Error (MAPE) on these models has plunged from 18.2% to 9.7%, yielding predictive confidence that first appeared improbable a decade ago. Effectively, planning has evolved from static spreadsheets to fluid, AI-augmented “nowcasting.”

The Skills Revolution Driving Change

The steep adoption of workforce analytics isn’t merely a tech upgrade—it’s a deliberate and strategic adaptation to the evolving fabric of work itself. Jobs now mutate more violently because of AI, automation, and novel operating models. This relentless tempo imposes acute pressure on firms hoping to keep their workforce ahead. Collectively, 58% of HR executives point to shifting skill demands as their leading headache, even topping recruiting as a cited burden. Additionally, 81% of organizations acknowledge acute shortages in key tech capabilities, with data scientists, cybersecurity experts, and AI engineers topping the list of toughest vacancies to fill.

The World Economic Forum foresees that, within five years, nearly half of the competencies that today’s employees possess will become irrelevant or insufficient.

If these deficits are not tackled, the resulting productivity drag could shrink the global economy by $8.5 trillion before the end of the decade. Faced with this stark forecast, organizations are discarding the outdated practice of simply counting heads in fixed roles and are instead investing in skills-based workforce mapping, which breaks roles into discrete, observable capabilities. By taking this level of detail, firms can spot developing skill shortages in real time and decide whether to fill the gaps by retraining the existing workforce, hiring new talent, or both, rather than waiting for market pressures to dictate urgency.

Source: samelane.com

Decoding Job Market Signals: The Early Warning System

Open vacancies, viewed through the right analytical lens, stand out as one of the earliest, cleanest lights on the dashboard of labor-market health. They signal directional shifts one to three months sooner than internal HR performance indicators can move, enabling talent leaders to pivot before metrics such as turnover or vacancy rates force them into crisis-mode. By incorporating this external signal into workforce planning, HR shifts from behind-the-curve troubleshooting to being a seat-at-the-table partner with the business.

Key signals in job postings can give companies a competitive edge by translating chatter into actionable insights.

- Demand signals show when hiring heats up or cools. By drilling into posting volume broken out by region, discipline, level, and contract type, firms spot soon-to-be tight talent markets. For example, when a model flagged a 40% jump in data science roles in Q3 2024, the boards saw salary pressures weeks ahead and were able to match rival counter-offers before the bar got to the doorstep.

- Skills signals develop around the frequency of newly mentioned capabilities, the hyperspace of tagging “AI + Python + MLOps” in postings, and the evolving skeleton of job architectures. The narrative emerging from this data indicates capability ceilings before they crack into shortages. This allows firms to upskill the existing bench or tweak their talent maps. In 2024, a sudden spike in “customer experience design” alongside “data storytelling” told a story of a hybrid role coming to the fore, and employers began training incumbents to plug the gap.

- Compensation signals expose constrained market bandwidth weeks before voice-of-the-employee metrics. By monitoring salary ranges, signing bonus robbery, and unusual benefits, the workforce strategy team was able to shorten formation time on a reloaded compensation philosophy. The upside is a pre-emptive leverage move that market competitors reacting to year-end compensation surveys need months to emulate.

- Competitor Intelligence is observing rivals’ hiring patterns provides early-warning signals of tactical shifts, enabling firms to identify potential market entrants or upcoming product releases weeks or months ahead of conventional signals. Spotting increased demand—for instance, a spike in demand for regulatory lawyers or cutting-edge supply-chain data scientists—can reveal a competitor preparing to enter a new region or sector, prompting more agile scenario planning and talent acquisition.

Source: prohance.net

The JobsPikr Advantage

JobsPikr has indexed 275 million position postings since 2007, spanning 195 countries, and refreshes this data nightly. By combining advanced natural language processing to extract skills and real-time salary trends, we offer HR leaders a comprehensive view of where demand, skill shortages, and compensation pressures are actually headed. The platform ingests and normalizes a torrent of unstructured listings, allowing customers to move from surface trends to causal narratives: to know, for instance, why a city suddenly attracts offers for remote-sensing engineers or why a stock listing suddenly attracts offers for data science. Where legacy systems freeze data in monthly snapshots, JobsPikr compresses yesterday’s postings into today’s market signals and delivers them as structured, easy-to-query datasets.

The Complete Workforce Planning Metrics Framework

The most advanced firms advance their workforce planning and analytics by anchoring talent decisions in a common structure of forward-looking and backward-looking data that weaves internal supply metrics—retention, internal mobility, skills certification—together with external lead indicators: projected hiring by core peers, skill-set geography shifts, and top-of-funnel revenue growth in adjacent sectors. By linking talent supply chains and external demand signals into a shared dashboard, such leaders turn uncertainty into systematic, testable hypotheses that support confident, dataguided workforce strategy.

Leading Indicators: Market Demand

These metrics give immediate hints that the external environment is shifting:

- External Hiring Velocity Index: Shift-calibrated postings fit the formula: (MonthN – MonthN-1) ÷ MonthN-1. An upward curve held for three months typically forecasts talent shortages and wage climb 2-3 quarters hence.

- Skills Heat Index: Skill frequency is weighed against prefall baselines, spotlighting emergent capabilities. Firms wielding the Heat Index see a 79% lift in above-benchmark decisions. The visual dashboard is a heat map, charting markets with color-coded temperatures that single out “hot” competencies.

- Compensation Pressure Index: Market medians are set against a midpoint spread: (MarketMedian – InternalMidpoint) ÷ InternalMidpoint. The difference, expressed as a percentage, flags roles at risk two quarters before turnover signals, so wages can be preemptively adjusted.

Leading Indicators: Internal Supply

These metrics finish the soft signals with a clarity sharpened by an organization’s own capacity and talent payroll:

- Skills Inventory Coverage: Net ability is cast against mandates: CurrentLevel ÷ RequiredLevel. Outcomes strengthen once databases are complete: enterprises armed with complete inventories react 34% swifter to external pivots, quickly reassigning in-house reservoirs to emergent roles.

- Bench Strength Score: Quantifies how ready successors actually are for critical leadership roles: (Ready Now + Ready in 1–2 Years) ÷ Critical Roles × 100. Firms where bench strength is solid cut leadership transition costs by 25% and enjoy noticeably higher employee morale.

- Internal Mobility Rate: Measures how often talent moves across departments: Internal Moves ÷ Total Employees × 100. Companies hitting high internal mobility averages see 30% better employee retention and save about $4,700 for every external vacancy they forgo filling.

Mixed and Lagging Indicators

- Pipeline Indicators: Time-to-Slate Quality (Qualified Candidates ÷ Total Candidates × 100) and Offer Acceptance Rate deliver early signals about how well talent acquisition is performing, well before hires are on board.

- Retention Risk Indicators: Machine learning analyzing 25–40 attributes now yields an 87% predictive accuracy for attrition, while parallel natural language processing assessments of employee sentiment offer a 76% accuracy. The combination allows firms to shape retention programs in real time.

- Outcome Metrics: Tracking revenue per FTE by skill cluster, alongside assessments of learning programs, demonstrates whether workforce planning resources are paying off and directs future spending.

Technology and AI: What Workforce Planning Looks Like in 2025

The underlying analytic tools have moved quickly from basic reporting to real-time, predictive environments.

Current State of Adoption

- 38% of organizations are already using dynamic workforce analytics.

- 70% of HR executives intend to deploy digital twins in the next 24 months.

- AI models now deliver high accuracy in workforce predictions: 87% certainty for understanding attrition and 90% for projecting broader workforce trends.

Quantified AI Impact

Enterprises that deploy AI-enhanced workforce-planning suites observe consistent and quantifiable gains:

- decision-making speed improves by 17 percent;

- talent outcomes rise by 21 percent;

- AI-driven scheduling trims labor costs by 18 percent;

- forecast precision is 35 percent sharper than conventional forecasting.

In parallel, digital twin technologies are amplifying these advantages. By generating risk-free virtual replicas, companies can test multiple future paths. Current findings show that firms analyze scenarios 29 percent more quickly, make decisions with 34 percent more confidence, identify risks 37 percent more frequently, and achieve 18 percent higher productivity after organizational adjustments. For instance, a virtual twin can project the effects of a new team layout or expanded remote work weeks before roll-out.

Overcoming Implementation Barriers

Even with these gains, hurdles persist:

- Poor data quality still affects 70 percent of projects, ensuring that flawed data yields misleading conclusions;

- 43 percent cite the challenge of integrating diverse HRIS, ATS, LMS, and external data streams;

- Privacy mandates, particularly GDPR, require 65 percent of organisations to overhaul data collection and retention

- 67% of HR directors say converting data insights into actionable workforce steps remains a struggle.

Emerging solutions point the way forward: embedding BI and visualization tools lifts stakeholder engagement by 42%, while cloud-powered implementations drive rollout speed by 56%. Automation slashes routine analytic cycles by 60%, allowing analysts to pivot from data wrangling to delivering strategic insights.

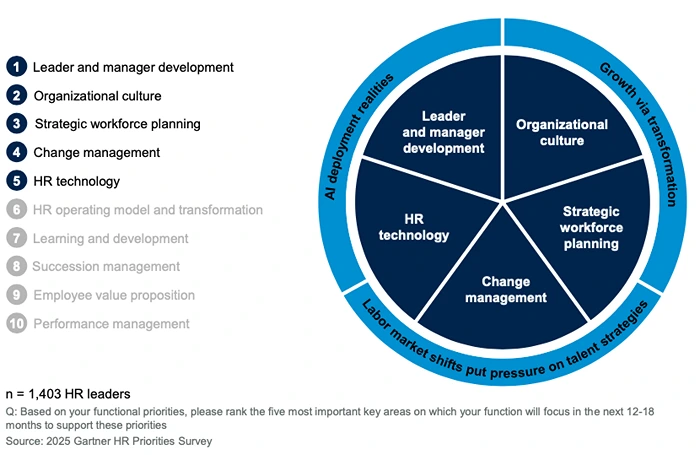

Source: Gartner HR Priorities Survey 2025

Industry Applications: Accelerating Workforce Planning

Employ advanced workforce analytics and users spanning every sector benefit.

Technology Sector Rollout

In technology, the sector not only confronts modern workforce planning headwinds, but also capitalizes on capability acceleration. Persistent changes to the tech stack and evolving skills create a fast-paced testing ground. Data science compensation surged 40% early in 2024, supply-side information was apparent months prior in job postings, well ahead of the next salary survey. Presently the footprint of AI and machine learning on job demands is unprecedented: co-occurrence patterns identify a surge in hybrid roles, merging pure code, domain fluency and product oversight. A Skills Heat Index lets firms measure when to move in-house engineers to new assignments and when to source talent externally, hence minimizing both expense and the elapsed time to deliver working product.

Healthcare Advantage

Healthcare organizations now leverage workforce analytics to tackle staffing shortages long before patients feel the strain. Early indicators reveal themselves in job posting trends, allowing teams to kick off recruitment and reassignment efforts ahead of the curve. Simulating staffing scenarios through digital twin models has transformed shift assignment; staff satisfaction surges by 22 percent while patient coverage stays in the green. The engines juggle skill distribution, patient severity, and caregiver preferences, crafting rosters that benefit both teams and clinical goals.

Retail and Logistics Optimization

Retail and logistics firms, anchored by narrow margins, trim labor costs by 11 to 15 percent through AI-driven schedules that pair workforce supply with demand science. Insights pulled from job posting patterns now forecast seasonal surges and trim project slip by 27 percent: spotting holiday needs, firms shift recruitment to the right weeks, leveling labor peaks without excess. That fine-tuned foresight guards budgets, keeping holiday hires in precise balance, protecting both customer lines and overtime costs.

Vendor Landscape and Selection Criteria

The workforce planning tools market has now narrowed to core types, each with distinct competitive edges. The largest HCM platforms—Workday, SAP, and Oracle—harness sprawling datasets and system integration muscle. Their foundations excel at wide-spectrum data capture; however, compact, fast-moving analytics may still sit outside their wheelhouse.

- Workforce Analytics Specialists: Providers like Visier and Sapience zero in on people analytics, packing in powerful modeling and tailored insights for specific sectors.

- Skills-First Platforms: Solutions such as 365Talents and Reejig focus on competency-based workforce planning and refining internal mobility.

- Strategic Workforce Planning Specialists: Orgvue and Anaplan offer sophisticated scenario modeling and simulation for intricate organizational blueprints.

Evaluation Framework

When picking workforce planning tech, ground the search in your measurement framework. Any platform must enable your selected metrics rather than just serving up static visualizations. Look for:

- Demand forecasting that integrates real-time external signals.

- Skills-level assessment refreshed in real time.

- Scenario planning driven by Monte Carlo simulation.

- Seamless integration with HRIS, ATS, and LMS systems.

Successful deployments synthesize top-tier analytics and thorough data integration, so insights evolve into concrete workforce actions.

ROI and Business Value Creation

The case for advanced workforce analytics is strong, delivering clear, quantifiable return on investment.

Skills-First Organization Benefits

- Employers that pivot to skills-based planning achieve disproportionate value.

- 30% boosting in productivity against role-limit models.

- 83% of employees remain when reskilling is emphasized.

- Limiting external hiring through internal redeployment trims recruitment and onboarding spend by 30%.

Predictive workforce analytics ROI:

- 20% drop in turnover thanks to timely, tailored retention plans.

- 15% lift in tenure driven by customized employee journeys.

- 60% compression of time-to-hire via AI-optimized recruitment.

- 50% acceleration of onboarding facilitated by intelligent support systems.

These gains reinforce each other, creating a feedback loop that sharpens predictive accuracy with each data cycle.

Real-World Use of External Labor Signals

Firms testing platforms like JobsPikr can see rapid, measurable ROI:

- Weekly downloads of labor market signals deliver Hiring Velocity and Skills Heat metrics.

- Signals are overlaid with existing internal skill sets to drive detailed gap analyses between hiring, upskilling, or redeploying talent.

- Cross-reference with finance and operations groups to ensure workforce scenarios conform to strategic goals and budget restraints.

Such processes convert external labor market data into a proactive compass for workforce planning, steering talent strategy ahead of market shifts.

Ethical and Governance Imperatives

As predictive workforce analytics deepen, the imperative for ethics and governance sharpens.

- Minimum cohort sizes must be enforced to uphold individual privacy.

- Routine bias audits across demographic segments are essential to safeguard fairness and mitigate compliance risks.

- Explainable AI (XAI) delivers visibility to every algorithm-driven choice.

Nevertheless, no machine insight can replace human judgement on decisions that shape careers: promotions, succession, cuts. Hybrid governance harvests analytical power while shielding individual confidence and meeting legal benchmarks. Health metrics drive governance value: improved forecasting alacrity, shortened hiring cycles, higher internal mobility, lower attrition, and manager uptake of analytic tools.

Implementation Roadmap: Your First 90 Days

A phased playbook guarantees orderly migration to a workforce strategy under intelligent rigour.

- Foundation Phase (Weeks 1-2): Unify aspirations across teams and obtain visible sponsorship from senior leaders. Quantify present-state metrics and catalogue authoritative internal data repositories.

- Integration Phase (Weeks 3-6): Bridge core systems—HRIS, ATS, and LMS— to external labour cues. Cement data steward roles and sketch a detailed skills ontology. The stage yields a robust infrastructure for perpetual insight.

- Deployment Phase (Weeks 7-12): Release a pilot dashboard set letting users observe core accelerators: a Hiring Velocity Index, a Skills Heat Map, and an inflation-adjusted Compensation Index. Trial the skills-descriptor catalogue with a cohort and experiment with early attrition predictors.

Following the first ninety-day cycle, the cadence settles into steady-state operations: teams conduct week-after-week signal reviews against the labor market, skills and compensation data are reassessed every thirty days, scenario simulations are refreshed on the calendar’s quarterly rhythm, and the strategic workforce plan absorbs its annual tune-up.

A Remarkable Path: Edge Through Workforce Insight

The leap from annual, static headcount counts to mana-ged, continuously updated workforce operations is a watershed change in contemporary HR. Enterprises that weave broad planning metrics like vacancies, skills trajectories, rivalry pay into a steady cadency of market and signals-driven insights position themselves for lasting advantage: the ability to pivot fast, see around corners, and lift every dollar of human investment to its highest value. The evidence is compelling.

Organizations employing robust workforce analytics point to sharper year-on-year gains in revenue per employee, lower turnover, tighter labor costs, and systemic resilience in a rapidly changing marketplace. As technology-driven change compresses skills life cycles, firms that tune into actionable signals now will trump those locked into once-per-year headcount forecasts. The technology is field-tested, deployments are scalable, and the science organizes itself around proven methodologies.

Signals that are real and actionable are already coursing through every labor overlay: attrition rhythms, compensation flex, emerging-demand roles. They are alerting adaptive teams to real opportunity and hidden risk well in advance of the static metrics reported after each closed fiscal quarter. The decisive issue today isn’t the simple necessity of powerful workforce planning tools, but whether you will adopt them soon enough to deny rivals the chance to outpace you strategically.

Are you prepared to anchor your workforce strategy in the instant clarity only current job-market intelligence can provide? Discover how data captured by JobsPikr can recalibrate the workforce planning KPIs you will report for 2025.

FAQs

1. What is workforce planning and analytics?

Workforce planning and analytics is like using a map and a compass when you set sail toward big organizational goals. It helps leadership line up talent strategies with the company’s objectives by pulling in numbers and facts. First, planning figures out who, when, and how many people will be needed in the future. Then, analytics digs into statistics like turnover rates, costs of unfilled spots, and the success of hires. By merging the two, HR shifts from waiting for issues to appear and doing damage control, to predicting future bumps in the road and prepping the best route ahead of time.

2. What are the 6 steps of workforce planning?

The typical 6 steps of workforce planning are:

Monitoring & Evaluation: Track results using workforce planning metrics and refine strategies continuously.

Strategic Alignment: Link workforce needs with organizational goals.

Demand Forecasting: Project future roles, skills, and headcount requirements.

Supply Analysis: Assess current workforce capabilities, skills, and pipelines.

Gap Analysis: Compare supply versus demand to identify shortages or surpluses.

Action Planning: Develop strategies such as hiring, upskilling, redeployment, or automation.

3. What is the role of HR analytics in workforce planning?

HR analytics provides the evidence base for workforce planning by turning employee and labor market data into actionable insights. It supports decisions around recruitment speed, skills gaps, turnover risks, compensation pressures, and internal mobility. By integrating HRIS/ATS data with external signals such as job postings or salary trends, HR analytics enables leaders to predict future needs, reduce planning errors, and improve ROI from workforce initiatives.

4. What is the difference between HR analytics and workforce analytics?

HR Analytics: Focuses on HR-specific functions such as recruitment efficiency, performance management, engagement, and turnover.

Workforce Analytics: Broader in scope, combining HR data with external labor market signals (job postings, salary benchmarks, skill trends) to forecast demand, assess supply, and model workforce scenarios across the organization.

5. What are the different types of workforce analytics?

Descriptive Analytics explains what happened (e.g., past attrition trends).

Diagnostic Analytics explains why it happened (e.g., root causes of high turnover).

Predictive Analytics forecasts what will happen (e.g., risk of vacancy spikes or skill shortages).

Prescriptive Analytics recommends what to do (e.g., hire externally, reskill, or redeploy talent)