- **TL;DR**

- Why Layoffs and Hiring Are Happening at the Same Time

- The Jobs Are Out There, So Why Aren’t They Getting Filled?

- What’s Really Behind the Rise in Job Cuts

- The Growing Gap Between Job Data and Job Reality

- What Smart Businesses Are Doing Differently in 2025

- Turning Data Into Direction: How Labor Market Analytics Helps You Act Smarter

- FAQs:

**TL;DR**

This year, the U.S. labor market feels like it’s moving in two directions at once. On one side, companies are cutting jobs at a steady pace. On the other hand, some industries are desperate to fill roles that have been sitting open for weeks or months. What gives? In this piece, we break down the numbers, look at what’s really driving this split, and explain why access to real-time labor market analytics is more important now than ever.

Why Layoffs and Hiring Are Happening at the Same Time

This year’s job market in the U.S. has people scratching their heads. On one side, companies are cutting staff. On the other hand, job boards are packed with openings. How can both be true?

The answer lies in how businesses are adapting. After years of aggressive hiring, many firms are now right-sizing. According to a 2025 mid-year report from Challenger, Gray & Christmas, over 425,000 job cuts were announced in the first half of the year, driven largely by sectors like tech, retail, and finance. But that doesn’t always signal trouble. In many cases, these are companies realigning around new priorities, not collapsing.

Meanwhile, job postings tell a different story. The U.S. still had over 8 million open positions as of May, according to the BLS. That’s down slightly from last year, but still well above pre-pandemic levels. Roles tied to clean energy, AI, and supply chain automation are leading the charge. In fact, demand for AI specialists alone is expected to grow by 36% this year, outpacing nearly every other category.

So what’s really happening? Companies are letting go of some roles while actively trying to fill others. One department shrinks, another grows. It’s not a downturn—it’s a reshuffle.

And without reliable labor insights, it’s easy to misread the whole thing. That’s where labor market analytics comes in. It doesn’t just count job cuts or listings—it adds context. With the right job data provider, you can see which industries are evolving, which roles are becoming obsolete, and where the real opportunities are emerging.

The Jobs Are Out There, So Why Aren’t They Getting Filled?

Image Source: TogglHire

Here’s what doesn’t make sense on paper: there are millions of open jobs across the U.S., more than we saw during the post-pandemic hiring surge. And yet, those positions are sitting unfilled for weeks, sometimes months. In some industries, they never get filled at all.

The knee-jerk explanation is that people don’t want to work. But that’s not really the issue.

A lot of these open roles require highly specific skills. Jobs in AI, clean energy infrastructure, and specialized healthcare—like bilingual nursing or mental health support—are all growing fast, but the talent pool hasn’t caught up. According to a 2024 report by the National Skills Coalition, over 50% of job openings require skills that fewer than one-third of workers have training in. It’s not a shortage of interest—it’s a shortage of qualified candidates.

Location plays a role, too. Many openings are clustered in areas where the right workers simply don’t live. A 2025 Brookings study highlighted that over 40% of U.S. job postings in growth industries are in regions with low access to relevant workforce training programs. Asking someone to relocate for a role that doesn’t offer hybrid flexibility or a competitive wage just isn’t a strong pitch anymore.

And then there’s the employer side. Some companies are still using outdated job descriptions. Others are setting expectations that don’t match market realities—like asking for five years of experience in a tool that’s only been around for two. In many cases, they’re holding out for a “perfect hire” who either doesn’t exist or already has a better offer.

This is exactly where labor market analytics becomes essential. It helps businesses understand what’s happening behind the posting data. Which roles are getting filled quickly? Which ones are dragging? Are your salaries in line with the market, or are you silently pricing people out?

With strong job data analytics and a reliable job data provider, you can shift from guesswork to strategy. You’ll know when to raise your offer, when to adjust your criteria, or when you’re chasing a talent pool that just isn’t there.

Hiring in 2025 isn’t about who can post the most roles—it’s about who understands what the market is telling them, and who’s willing to adapt.

What’s Really Behind the Rise in Job Cuts

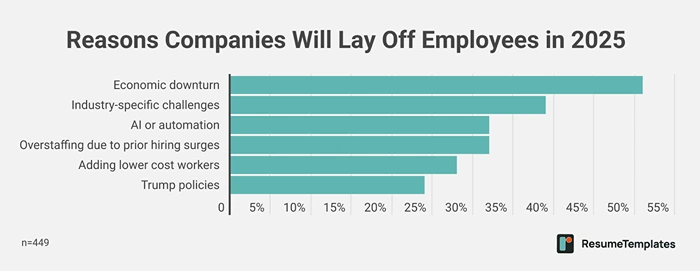

Image Source: Resume Templates

Now let’s talk about the other side of the coin—layoffs. They’re happening across multiple industries, and it’s not just the usual suspects like tech and media. Even sectors that were booming two years ago, like logistics and e-commerce, are scaling back.

The reasons aren’t always dramatic. In a lot of cases, it’s simply a correction. Companies overhired during the pandemic rebound and are now trimming down to match slower growth. It’s not that their business is collapsing—it’s that their forecasts were too optimistic.

Other times, it’s about shifting priorities. Take tech, for example. Firms that once bulked up on support roles and middle management are now reallocating resources toward AI development or automation. So you’ll see layoffs in one part of a company, while another team is still hiring. In some cases, those announcements hit the same press release—cutbacks in ops, new roles in engineering.

On top of that, there’s just a lot of uncertainty hanging over everything. Yes, people are still spending, and the jobless rate isn’t bad. But interest rates are high, supply chains haven’t fully stabilized, and certain industries are playing it cautious, unsure of what’s around the corner. So businesses are playing it safe. And job cuts are the first lever many pull to protect margins.

But here’s the key: not all layoffs mean a sector’s in trouble. And not all job growth means a sector is safe. You need more than headlines. You need labor insights that show where the demand is real and where it’s just noise.

That’s where labor market analytics is critical. It helps you go deeper than surface-level job data. Which types of roles are getting cut? Are those cuts isolated or industry-wide? What are the posting trends in the same vertical? A smart job data provider will help you connect those dots so you don’t overreact—or worse, miss an opportunity.

Because in 2025, assuming too much from a single layoff report or hiring spike is a fast way to make the wrong call.

The Growing Gap Between Job Data and Job Reality

Not all job data tells the full story. Relying on outdated or shallow numbers might be the reason so many businesses are misreading the labor market right now.

The Problem with Static Reports

Most of the data people rely on—government reports, monthly surveys, or press releases—only show you a snapshot. It might tell you how many people were hired or fired last month, but not what’s happening right now. And it definitely won’t tell you why those changes are happening.

Even worse, those reports usually lump roles together. A headline might say “Tech layoffs rise,” but that could mean anything from helpdesk staff to cloud infrastructure engineers. There’s no nuance—and no context.

Job Boards Aren’t Much Better

A lot of companies still treat job boards like a crystal ball. They search for the number of postings and assume that means growth. But not every posting leads to a hire. Some stay up forever. Others are repeated, syndicated, or even outdated.

Looking at job boards without filtering out noise is like trying to predict traffic using a road map. It gives you direction, but not the conditions.

Real-Time Labor Market Analytics Matters

This is where labor market analytics makes a real difference. It’s not about looking backward—it’s about seeing what’s actually happening on the ground. A solid job data provider will strip out duplicate listings, flag slow-to-fill roles, and show you hiring velocity across specific functions or locations.

That’s the kind of insight you can act on. For example, if a region is posting more roles in clean energy than any other in the country—but the fill rate is low—you’ve just uncovered a talent gap. That might be a hiring opportunity. Or an investment one.

Data that just counts jobs isn’t enough anymore. You need tools that explain the behavior behind the numbers. That’s what real job data analytics does. And in a market that’s shifting as quickly as this one, you can’t afford to guess.

What Smart Businesses Are Doing Differently in 2025

If 2025 has made one thing clear, it’s this: the old hiring playbook doesn’t work anymore. Companies that are still relying on static reports, broad forecasts, or last year’s strategies are either over-hiring or over-cutting. The businesses that are staying ahead of the curve are doing a few key things differently.

They Don’t Wait for Quarterly Reports

By the time labor statistics make it into a government release or an investor brief, they’re already outdated. Take job data from the Bureau of Labor Statistics—it’s useful, but always a few weeks behind. By the time those numbers drop, the market may already be moving in a different direction. Helpful for spotting long-term shifts, sure, but not much good if you need to adjust quickly.

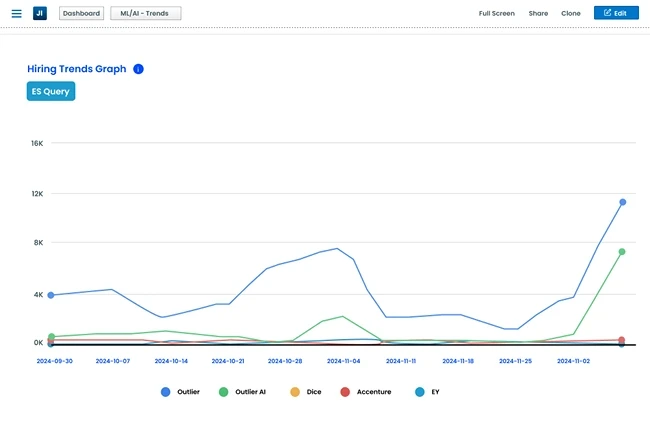

That’s why more companies are leaning on real-time labor market tools. They’re not waiting for reports—they’re tracking live job activity, watching what’s opening, what’s slowing down, and where the momentum’s shifting. They can see when a competitor starts quietly expanding in a new region or when job cuts hit a specific role type across multiple firms. That gives them time to plan, not just react.

They Look at Hiring Velocity, Not Just Job Volume

It’s easy to be fooled by raw posting numbers. What matters more is how fast those jobs are being filled—or whether they’re being filled at all.

For example, in Q2 2025, data from multiple job intelligence platforms showed that software engineering roles in the AI sector had a median time-to-fill of 45 days. But in fields like renewable infrastructure, many open roles stayed up for 70 days or more. Smart companies don’t just chase sectors with the most listings. They look for the ones with the biggest unmet demand.

That’s where job data analytics comes into play. It reveals friction—places where hiring is slow or stalled. That can be a red flag, or it can be an opening, depending on your strategy.

They Use Labor Insights to Rethink Their Own Plans

This isn’t just about tracking competitors. It’s also about holding up a mirror.

Companies that use deep labor insights are spotting gaps in their own hiring patterns—roles they’re consistently struggling to fill, markets where they’re losing out on talent, or salary ranges that are out of sync with the region. That kind of feedback loop isn’t something you get from a spreadsheet. It comes from working with the right job data provider, one that can give you a live view of how your hiring activity compares to the rest of the field.

In 2025, the smartest organizations aren’t just paying attention to the job market—they’re plugged into it. They’re moving with it, adjusting quickly, and using data that’s alive, not archived.

Turning Data Into Direction: How Labor Market Analytics Helps You Act Smarter

Understanding the labor market isn’t just about reading the latest layoff memo or checking which jobs are trending on LinkedIn. Those are signals, sure—but they don’t give you direction. That’s where most companies go wrong. They chase noise instead of patterns.

Data Is Only Useful When It’s Actionable

Plenty of businesses collect data. Fewer know how to use it well. They gather spreadsheets full of job titles, postings, and salaries—but without context, it’s just clutter.

The companies that move confidently in 2025? They’re not just looking at dashboards. They’re asking better questions. What roles are drying up in our space? Where are the new ones emerging? Are we losing talent to competitors in a specific metro area, or are our own listings part of the problem?

The answers come from good data, yes—but also from good interpretation.

Labor Market Analytics Isn’t Just for HR Anymore

Once upon a time, labor insights were mostly a tool for talent acquisition. Now? They’re informing everything from product planning to investor strategy.

A retail brand might use job data analytics to predict where competitors are expanding brick-and-mortar operations. A VC firm could track hiring slowdowns across startups in its portfolio. A logistics company might monitor warehouse job postings to spot regional supply chain strain before it hits margins.

The point is: data that starts with jobs doesn’t stay in HR. With the right job data provider, you can turn that information into strategic direction across departments.

You Don’t Need More Guesswork, You Need Better Visibility

2025 isn’t offering many guarantees. The economy is steady one quarter, wobbly the next. Demand in one sector spikes while another quietly contracts. You could try to navigate all that with guesswork—or you could use labor market analytics to actually see what’s happening.

Not surface-level summaries. Not recycled quarterly charts. Real insight, in real time.

That’s what separates the companies that are surviving this strange, uneven job market from the ones that are finding ways to grow in it.

Seeing the Market Clearly Means Acting Smarter

There’s no denying it—2025 has been one of the most unpredictable years for the U.S. labor market in recent memory. Job cuts are happening in waves, yet new openings continue to pop up across industries. It’s not chaos. It’s realignment.

For business leaders, hiring teams, and investors, the challenge isn’t spotting the shifts—it’s understanding them. Guesswork and gut instinct won’t cut it anymore. What you need is visibility. The kind that goes deeper than reports and faster than headlines.

That’s where JobsPikr can help.

With JobsPikr, you’re not just looking at job trends—you’re digging into what’s causing them. We track real-time hiring activity from thousands of sources, clean out the noise, and turn it into something you can use. No filler, no fluff—just clear labor market signals you can act on.

If you’re trying to figure out where the demand is going, how your hiring compares to the field, or where gaps might hit next, this platform gives you the visibility to stay ahead. You’ll know more—and move faster—because the data’s not just current, it’s built to make sense.

Let JobsPikr be your unfair advantage in a labor market that doesn’t stand still. Schedule a demo today.

FAQs:

1. Why are job cuts still happening if there are so many open roles?

Job cuts and job openings can exist at the same time because they’re usually happening in different parts of the economy. A company might lay off staff in outdated departments while hiring aggressively in new areas like AI or clean energy. What looks like a contradiction is actually just a realignment of skills and priorities.

2. Can labor market analytics help my business avoid bad hiring decisions?

It can, especially if you’re making big calls in an uncertain market. Without solid data, you might be hiring into a role that already has too many people chasing it—or offering a salary that’s totally out of step with the going rate. Labor market analytics helps by giving you a real-world picture of what’s happening now, not three months ago. That kind of visibility makes a big difference.

3. What should I look for in a job data provider?

You should expect more than just a data dump. A good job data provider gives you structured, clean information—like which companies are hiring for what roles, how long those roles stay open, and where demand is heating up or cooling off. It’s not just about volume; it’s about knowing what the numbers mean so you can act on them.

4. Why are so many jobs staying open for so long in 2025?

There’s a mix of reasons. Some of it’s about expectations—companies wanting a “perfect” candidate who doesn’t really exist. Sometimes it’s about location, or pay, or a job that asks for five different skill sets wrapped into one role. A lot of these listings aren’t ignored—they’re just not matching the market. And that’s slowing everything down.

5. How does JobsPikr’s job scraping software work—and why does it matter?

Think of it like this: the internet’s full of job posts, but most of them are noisy, repetitive, or out of date. What JobsPikr’s job scraping software does is gather all that raw data from thousands of sites, clean it up, and turn it into something you can actually use. Whether you’re planning a hiring push or scouting where the market’s headed, it helps you move based on facts—not guesswork.