- **TL;DR**

- What Is A Talent Marketplace?

- Turn Market Signals Into Internal Mobility Strategy

- The AI Advantage: Beyond Traditional Systems

- Why Now: 2025 Signals You Can't Ignore

- The Talent Marketplace Adoption Curve

- Turn Market Signals Into Internal Mobility Strategy

- Marketplace vs. Traditional Recruiting

- The ROI Stack for a Talent Marketplace

- ROI Calculation Framework

- Change Management for Marketplace Adoption

- Three anonymized success cases

- 90-Day Pilot Plan

- Turn Market Signals Into Internal Mobility Strategy

- The Skills Graph Revolution

- Talent Marketplace & Workforce Planning Integration

- The Talent Marketplace Moment

- Turn Market Signals Into Internal Mobility Strategy

- FAQs

**TL;DR**

The emergence of talent marketplaces is no longer a forecast: it is actively unfolding. As of 2025, 75% of organizations intend to allocate resources toward AI literacy training, with 43% prioritizing AI integration, fostering a skills-first ecosystem needed for these platforms to thrive. By the end of the year, 30% of large enterprises are projected to have adopted a talent marketplace platform, although only 15% will achieve full company-wide adoption. An internal talent marketplace not only improves over the traditional methods, but it can decrease the time-to-fill a position by up to 20 days, cut hiring costs by 3–5x, increase the available talent pool by over 6x, and improve retention by up to 86%. With Jobspikr, real-time market signals can be transformed into actionable insights, skills can be mapped, gaps highlighted, adoption curve measurable, and ROI accelerated.

The talent marketplace revolution is no longer a prospective idea—it’s in progress, marked by macro signals pointing to an inflection point. 75% of organizations intend to provide AI literacy training, and 43% list AI integration as their primary focus for 2025. This focus on skill acquisition is foundational to the operating paradigm on which talent marketplaces depend. Adoption of talent marketplaces stands at a critical crossroads: 30% of large enterprises expect to implement talent marketplaces by 2025, but only 15% expect company-wide adoption for all employees.

The marketplace model and traditional recruitment model are leagues apart in effectiveness. Internal redeployment streamlines the time-to-fill metric by 20 days, with a 3-5x reduction in cost compared to external hiring. There are substantial hard ROI metrics. Large reductions in contractor spend, significantly quicker project ramp-up times, and retention increases of 3-5 percentage points in targeted cohorts are all very persuasive. Employees with higher internal mobility stay with an organization for an average of 5.4 years, compared to 2.9 years in low-mobility organizations.

The 90-day rollout plan that we developed this year leverages indicators of readiness for 2025, from investment in AI literacy to hybrid work recalibration, to expedite adoption. There is a nap in the shutter: the ratio of skill to requirement increased from 56% in 2022 to 81% in 2024, which strengthens the foundational infrastructure that talent marketplaces need to flourish.

What Is A Talent Marketplace?

Source: Change Leaders

A talent marketplace is an AI-powered platform that connects employees with internal positions, opportunities, or projects that correspond with their skills, interests, and career aspirations. Talent marketplaces work quite differently from older applicant tracking systems (ATS) or human resource information systems (HRIS). They utilize advanced algorithms that infer skills, intelligently match candidates and positions, and apply behavioral nudges, to perform dynamic talent allocation which define a modern talent marketplace platform.

Grasping the difference between internal and external talent marketplaces is important for understanding the deployment strategy. Internal talent marketplaces operate with an exclusive focus on employee relocation within a company and use proprietary skills analytics, and employee performance and career aspirations data. These systems have an intricate interface with the existing HRIS infrastructures to retrieve holistic employee data while enforcing strict compliance to privacy and information protection policies.

By contrast, external marketplaces focus on linking organizations to freelancers, contractors, or candidates from the external market. A hybrid model is the most common, where internal redeployment is facilitated alongside external talent sourcing through a single interface. This functionality is increasingly important as organizations embrace more agile workforce strategies.

Turn Market Signals Into Internal Mobility Strategy

ee how JobsPikr helps you map skills supply, forecast gaps, and accelerate marketplace ROI.

The AI Advantage: Beyond Traditional Systems

The features of the AI talent marketplace represent progress beyond traditional systems. In an AI talent marketplace, skills inference engines create detailed capability profiles by analyzing job descriptions, learning histories, and even project contributions. Non-obvious matches, such as marketing analysts and supply chain optimizers, are interlinked by machine learning algorithms. Intelligent nudges help managers remember internal candidates that might be forgotten and recommend focused career pathways tailored to help employees gain skills that are in high demand.

As talent marketplace software, it sits in the modern tech stack with the learning experience platforms (LXP) and skills taxonomy as well as the human resource information systems (HRIS) and employees databases, applicant tracking systems (ATS) for external candidate sourcing, and vendor management systems (VMS) for contractor supervision. The intricate nature of talent marketplace software connections is the reason only 30% of large enterprises have successfully adopted these talent marketplace platforms, and, even with a large interest, they are still not widely implemented.

Why Now: 2025 Signals You Can’t Ignore

Organisational Priorities: 2025

Organisational priorities for 2025 stand to create unmatched momentum toward the adoption of talent marketplaces. In this case, impetus is not isolated. In fact, it is a convergence of various trends that provide the necessary infrastructure marketplaces need, for instance, 43% prioritize AI integration as their top strategic initiative.

This alignment is not random or coincidental. For instance, companies that are hybrid working require better visibility into the skill sets available in the distributed workforce. Organizations with a strong focus on AI transformation require a more agile talent management. Enterprises need readily usable frameworks to apply newly developed skills.

AI Literacy: The Foundation Signal

An enterprise that plans AI literacy training for 75% of its employees is certainly working toward the necessary skill-oriented culture that talent marketplaces bank on. It’s more than just training; it marks a key change in the way organizations grapple with organizational capability. After all, losing and winning in a competitive organizational landscape is simply about empowering employees to think about their abilities in granular, actionable terms like ‘Python programming’, ‘data visualization’, and ‘change management’. The absence of such a value framework means that the ability to match and adopt becomes stagnated.

The statistics make it clear that there is an accelerating pace of change: 86% of executives believe AI and information processing will transform businesses by 2030, and already 54% of CEOs are recruiting for AI-related positions that did not exist a year ago. This pace of skill evolution makes traditional, job-title-oriented recruiting obsolete.

The Skills Demand Landscape: Beyond Job Titles

Reinforcing the logic of the marketplace, the most sought-after capabilities for 2025 marks a departure from traditional recruiting:

Analytical thinking is the most sought-after skill at 70% of companies AI and big data are the fastest-growing skill categories Resilience, Flexibility, and agility complete the top requirements All these competencies can be better identified through skills-based matching rather than by job title screening. When being able to quickly redeploy analytical talent becomes a competitive advantage, organizations need skills-based recruiting platforms that are not limited to traditional boundaries.

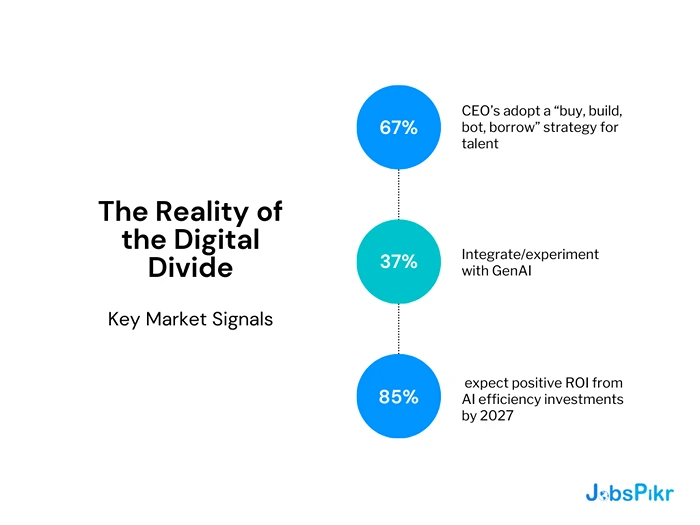

The Reality of the Digital Divide

Data on the hiring outlook reveals a critical and deepening split alongside marketplace value. While 39% of EMEA CEOs anticipate a greater than five percent increase in headcount over three years, the pace of adoption diverges sharply by sector. Technology and professional services lead hiring plans, while traditional industries exhibit increasing caution. This gap creates internal demand for skill redeployment, which is precisely where marketplaces excel.

Global Context: Talent competition may not be new, however, internal supply agility presents a new paradigm shift. Marketplaces do not address the issue of talent scarcity, rather, they optimize the use of available talent resources and minimize reliance on outside resources.

Key Market Signals:

- 67% of CEO’s adopt a “buy, build, bot, borrow” strategy for talent

- 37% are integrating/experimenting with GenAI (up from 27%)

- 85% expect positive ROI from AI efficiency investments by 2027

The Talent Marketplace Adoption Curve

Enterprise adoption follows a classic innovation diffusion curve, with tangible markers defining each phase.

Innovators & Early Adopters: The Technology Leaders

Market segment: Global tech firms, consulting companies, skill-intensive service providers Penetration: Currently 15% of enterprises

The earlier a business adopts new technologies, the higher its competitive advantage. These businesses have a higher adoption tendency for the following reasons:

- AI-first strategic agendas with autonomous decision-making

- Substantial volumes of project-based work driving demand for on-demand flexible talent

- Defined skills taxonomies and data architecture

- 81% adoption of skills-based hiring

In this cohort of leaders, talent marketplaces are not a new concept; for them, the focus is on integration enhancing the evolution of business processes.

Early Majority: The 2025 Opportunity

The early majority offers what is arguably the most interesting opportunity in 2025. Heavily regulated financial services, pharmaceuticals, and energy sectors are testing internal talent mobility systems as a workaround to stagnant hiring while trying to sustain business growth.

Transformation readiness indicators comprise:

- Return-to-office recalibrations spawning a need for better spatial and talent optimization.

- Investment in learning infrastructure and skills academies.

- Modernizing role definitions in the refresh job architecture initiatives.

- Strong transformational change management competencies from prior change management initiatives.

The missing element: Agility in technical operations of pure technology firms. This gap, however, is closing rapidly in response to digitized operational framework industries.

Late Majority and Laggards: Growing Pressure

Current state: Title-centric organizations with fragmented data ecosystems, low human resource technology maturity, high requisition compliance friction, and low HR Technology Maturity.

The World Economic Forum forecasts mounting pressure, estimating that 59 out of 100 workers will need retraining by 2030. This is a wake-up call, especially for traditionally slow-moving sectors.

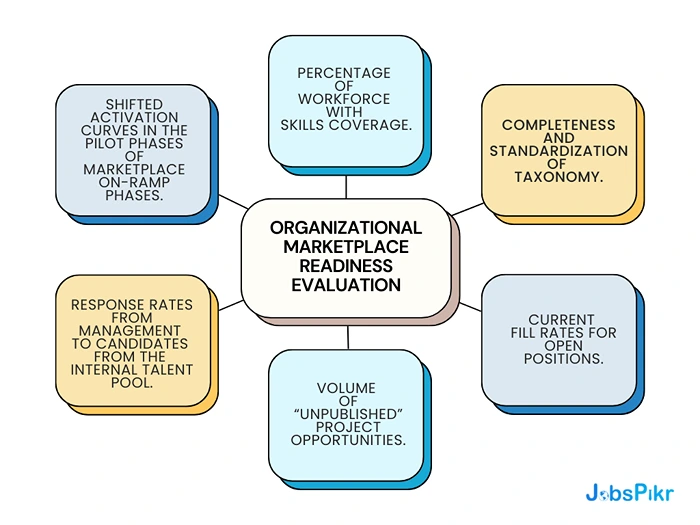

Self-Assessment: Organizational Marketplace Readiness Evaluation

Market readiness can be assessed with critical performance indicators and organizational skill metrics:

- Percentage of workforce with skills coverage

- Completeness and standardization of taxonomy

- Current fill rates for open positions

- Volume of “unpublished” project opportunities

- Response rates from management to candidates from the internal talent pool

- Shifted activation curves in the pilot phases of marketplace on-ramp phases.

Geographic adoption patterns reveal interesting trends: Australia and Latin America lead adoption rates. The United States has strong readiness with 87% skills-based hiring, while France significantly lags in marketplace deployment.

Future trajectory: Early Majority Adoption is accelerating for carefully targeted adoption, as Gartner notes that 35% of large enterprises will implement talent marketplaces by 2027.

Turn Market Signals Into Internal Mobility Strategy

ee how JobsPikr helps you map skills supply, forecast gaps, and accelerate marketplace ROI.

Marketplace vs. Traditional Recruiting

The gap in performance between talent marketplaces and traditional recruiting is measurable along six key dimensions, all of which demonstrate improvements that warrant investment.

Speed: Dramatic Time Advantages

Internal recruitment alone shaves 20 days off the time-to-fill for external hires. This, along with:

- 25% improved candidate skill-set matching with the identification of relevant profiles

- 30-40% better cycle times for staffing projects

- Internal hires accelerate time-to-productivity for onboarding processes

For project-based firms, these speed improvements aid competitive positioning by enabling quicker launch of initiatives and reduced opportunity costs.

Cost Efficiency: The Strongest ROI Lever

Internal redeployment is 3-5 times cheaper than external hires due to recruitment fees, signing bonuses, and longer onboarding processes.

The Financial Reality:

- External Recruitment: 90-200% of a Position’s Annual Salary

- Internal Moves: 1.7x less expensive (considering training costs)

- Skills-based Hiring: 30% Average Reduction in Costs Associated with Recruitment

- Industry Benchmark: Average Cost-Per-Hire $4,425

- Quality & Retention: Value Creation

Internal mobility enhances and creates cumulative organizational value:

- Workers promoted internally: 70% more likely to remain long-term

- Lateral internal moves: 62% retention rate compared to 45% for external hires

- Companies with high internal mobility: Average tenure of 5.4 years

- Companies with low internal mobility: Average tenure of 2.9 years

Strategically shifting employees upwards internally leads to 86% improvement in retention.

Utilization: Unlocking Hidden Capability

Skills-based approaches increase talent pools:

- Globally: 6.1x

- U.S. Candidates: 15.9x

- AI Roles: 8.2x

- 70% of skills can be repurposed to other initiatives.

This reduced external hiring needs and accelerated internal capability development.

DEI & Experience: Further Organizational Advantages

Shortlists based on skills mitigate pedigree bias, focusing on proven capabilities. 83% of employers reported active DEI initiatives in 2024 (up from 67% in 2023) with marketplaces offering measurable tools to advance these goals.

Marketplace platforms enhance visibility and accessibility which improves employee and manager satisfaction by a measurable metric.

| Metric | Traditional Recruiting | Talent Marketplace | Improvement |

| Time-to-fill | 45-65 days | 25-45 days | 20+ days faster |

| Cost-per-hire | $4,425 average | 3-5x less internal | 70%+ savings |

| 2-year retention | 65% | 85%+ | +20 percentage points |

| Skills pool size | Baseline | 6.1x expansion | Much larger |

The ROI Stack for a Talent Marketplace

Talent marketplace ROI consists of four primary value streams, and each has its own measurement and baseline requirements.

1. Direct savings: Immediate cost benefits

The most direct ROI metric is derived from avoided external recruitment costs, resulting in a:

- 25-35% reduction in agency fees 15-25% reduction in contractor dependencies $4,425 average cost-per-hire (baseline industry value)

- The majority of organizations recognize cost benefits immediately where internal redeployment replaces external hire and contractor relationships.

2. Velocity Gains: Speed Creates Compounding Value

Time-to-fill metrics translate to several business advantages. For example:

- 20-day reduction in internal recruitment 25-40% acceleration in project staffing cycles Reduced unfilled position opportunity costs Increased business responsiveness

- The cumulative impact of velocity gains often far exceed direct cost savings by enabling faster project launches and reduced operational downtime.

3. Productivity & Retention: Long-Term Value Creation

Retention economics offer notable returns over a longer duration:

- 33% of annual salary = typical replacement cost

- $49M annual loss due to turnover at large enterprises (due to lack of upward mobility)

- 3-5 percentage point retention improvements due to internal mobility

- Readiness to promote from within increases retention by 70%.

- High-growth companies incur tangible costs from turnover that talent marketplaces resolve by enhancing career visibility and opportunity access.

4. Capacity Unlocked: Organizational Leverage

The reuse of skills and allocation to multiple projects results in organizational leverage:

- 70% of skills can be reused and reshaped…with proper skill and talent management.

- Reduced need to hire externally

- Faster rate of internal skill and talent management development

- Improved allocation of resources to projects.

- When organizations can redeploy existing capabilities to new initiatives, they reduce the need to hire externally, which fosters the development of internal capabilities.

ROI Calculation Framework

Primary Formula:

ROI = (Cost Savings + Velocity Value + Retention Value – Platform & Change Costs) / Total Investment Costs

Detailed measurement components:

- Cost Avoidance: (Alternate hires not engaged × $4,425) + Agency fee reimbursement + Savings from contractor services

- Velocity Value: (Days saved × Average daily salary of open positions) + Benefits of accelerated projects

- Retention Lift: (Turnover reduction % × Employee count × 33% average salary)

- Capacity Value: Additional projects completed (Revenue generating services).

Attribution Strategy: Measure of True Impact

Effective ROI measurement necessitates a business unit-level A/B pilot within a controlled marketplace exposure framework for access and alongside access comparisons within a defined unit. Pre and post measurement tracking by role family, geography, and skill cluster ensure measured impacts are unconfounded by marketplace exposure. Minimum 6-month measurement windows guarantee retention impact bias is mitigated.

2025 ROI amplifiers: Market places are expected to deliver compounding value from skill development and immediate application for 65% of organizations that are expecting upskilling and 75% of those investing in AI literacy.

Change Management for Marketplace Adoption

Deploying a marketplace successfully requires the application of a systematic approach to change management that encompasses both technology and behavior. The 6R Framework provides comprehensive coverage: Reason, Roles, Rules, Reskilling, Rewards, and Rollout.

Reason underscores the strategic importance far exceeding efficiency improvements. Organizations need to explain how marketplace evolution fulfills strategic goals like AI-powered transformation, agility improvements, and talent retention, rather than simply automating tasks.

The business case should draw from the 2025 insights: 54% of CEOs are hiring to fill roles that didn’t exist a year prior. This underscores how challenging talent needs forecasting using traditional approaches is.

Role definition builds the governance model and defines the championship network. COE models are most effective with product owners, governance councils that include legal and privacy stakeholders, and business unit champions who understand the marketplace technology and talent dynamics regionally.

These rules enshrine policy boundaries and ethics critical to employee trust. Adoption resistance is mitigated through data privacy, bias oversight within AI matchmaking algorithms, and explainability obligations. Confidence in marketplace impartiality is bolstered through clear policies on internal versus external opportunity prioritization, managerial action timelines, and commitments to the employee development framework.

Understanding the Key Areas of Change in Manager Behavior

A behavioral manager adoption plan exemplifies the most reframing challenge of manager behavior change in the adoption plan outline. Consider the nudge personalization suggestions:

- Internal candidates for new openings should be auto-suggested.

- There should be SLA responses for applying internally.

- There should be alerts for skills gaps when externals are recruited.

- There are training sessions on evaluations that are blind to the skills biased and to unreasoned skills.

Trust and safety protocols mitigate genuine risks to matching done by AI through bias monitoring dashboards, algorithm explainability features, credibly demonstrating organizational commitment to verifiable outcomes, and human oversight protocols. In 2025, the strategic direction of the corporate system will be guided by the use of specialized software in the talent market. In choosing a marketplace for talent, we need to consider five critical factors.

Integration on its own complexity often dictates the success of the system more than its features in a given system. Beginning with the most sophisticated features of talent, we need to focus on skills observation. These features should be prioritized to assess skills to be more important than the breadth of features possessed.

Using automatic skills extraction from contributions, job and learning record descriptions delineates the level of matching effectiveness that will be achieved. Enabling flexible work through project and gig orchestration, alongside career pathway recommendations tailored towards in-demand skilled, will aid employee guided skill development.

Integration prerequisites typically make or break an implementation:

- HRIS and ATS integration for the employee and external candidate data flow.

- Learning experience platform connections for tracking skills and development.

- Single sign-on (SSO) for seamless user experience.

- Data lake connectivity for advanced analytics.

Given that internal employee data is sensitive information, security and compliance issues add layers that require role-based access control, rigorous audit trails, data retention policies, and residency restrictions based on geographic data for legal compliance.

Context on Market Growth: The platform market is expected to grow rapidly from 0.95 billion in 2024 to 1.5 billion by 2033, showing a 10.5% compound annual growth rate. This growth reflects increased investment from vendors and greater maturity of the platforms.

Three anonymized success cases

Case A: Global pharmaceutical enterprise

Initial challenges: Compounding roles across research silos, 65 day average fill time for niche roles, low internal mobility despite high employee engagement, high reliance on niche contract workers.

Adopted strategy: Activation of internal talent marketplace with AI skills graph, project-based gig roles, automated manager prompting systems, and manager nudges coupled with existing learning, feedback systems, performance appraisal systems.

Measurable outcomes: Staffing for R&DProjects shifted from a 45-day average to 29 days, a 35% improvement. Redeployment reduced contractor spend by 22%. In 9 months, internal mobility rates increased by 10 percentage points and employee engagement scores for marketplace-enabled divisions increased by 8 points.

Case B: APAC Financial Services

Starting challenges: A hiring freeze during a regulatory pause. A backlog for digital transformation. A traditional banking workforce that needed urgent reskilling to fit fintech roles. High attrition rates for technology roles.

Intervention approach: Skills academies that created direct links to marketplace jobs, AI-powered career pathways for roles in digital banking, and cross-divisional assignments with partner external education providers.

Measurable outcomes: 28% acceleration in time-to-productivity for internally redeployed staff. 4 percentage point increase in retention for target digital banking cohorts. Redeployed over 650 full-time equivalents to strategic growth initiatives. 31% reduction in external recruiting spend.

Case C: US Industrial Manufacturing

Initial Issues: Geography-based skill requirements, staffing difficulties due to seasonally fluctuating demand, rising agency costs for temporary staffing, and external hiring freedom due to safety certification requirements.

Selected Solutions: Internal temporary staffing and cross-plant temporary staffing through an internal multi-site talent marketplace, forward-looking shift opportunity marketplace for seasonal demand coverage, and integration of active skills profile with status of safety certification for triage.

Measured Results: Spending on agency staff reduced by 29% through internal temporary coverage, better shift allocation drove a 18% decrease in overtime hours, safety certification coverage increased 18% through cross-training, and 12% improvement in production efficiency with active skill deployment.

Note: Composite averages with ranges are illustrative. Each organization needs to verify metrics with controlled pilots prior to scaling.

90-Day Pilot Plan

Achieving success in deploying a marketplace requires methodical pilot implementation which builds trust in the organization and shows quantifiable value at the same time.

Weeks 1-3: Initial Activities

- Import and validation of existing skill taxonomies within HRIS/LMS frameworks.

- Creation of governance structures covering privacy and data protection, bias evaluation, and rule frameworks regarding data opportunities and allocation.

- Formation of a champion network within 2-3 targeted business units.

- Conduct integration testing with existing ATS and learning platforms.

- Conduct manager training on skills-based evaluations and marketplace workflow.

Weeks 4-6: Configuration and Integration

- Configuration of platforms including: reporting and feedback dashboards, algorithms for nudges and engagement, and data integration frameworks.

- Integration of HRIS/ATS systems and automated data flow.

- Micro-learning on AI for 75% of organizations with planned investments.

- Identification of pilot cohort with high engagement and project-based work.

- Launch an internal communication campaign on skills and career advancement pathways.

Weeks 7-9: Go-Live and Optimization

- Activation of the marketplace for 2-3 business units with 500-750 employees.

- Service level agreements on internal candidate turns for response.

- Collection and internal dissemination of success stories.

- Monitoring utilization in real-time, collecting user experience feedback.

- Activation of bias monitoring with algorithm reviews on a weekly basis.

Weeks 10-12: Assess and Decide on Scaling

- Calculation of ROI including cost avoidance, velocity improvements, and utilization.

- A/B comparison of pilot and control business units.

- Scale-up planning with full organization rollout in proposed timeline.

- Integration of external sourcing functions for a hybrid marketplace model.

Turn Market Signals Into Internal Mobility Strategy

ee how JobsPikr helps you map skills supply, forecast gaps, and accelerate marketplace ROI.

The Skills Graph Revolution

The evolution of the talent marketplace is increasingly powered by one core capability: the skills graph.

A skills graph is more than a static skills database. It is a dynamic, interconnected map of capabilities across the organization. It links people to skills, skills to projects, projects to outcomes, and outcomes to emerging business needs. Instead of storing “Python” or “financial modeling” as isolated tags, a skills graph understands how those capabilities relate to adjacent skills, proficiency levels, certifications, and real-world applications.

This is where modern marketplace platforms gain their edge.

From Skills Lists to Skills Intelligence

Traditional HR systems rely on self-reported skills or rigid job descriptions. These are often outdated and incomplete. A skills graph, by contrast, uses AI-driven inference to extract capabilities from:

- Project contributions

- Performance feedback

- Learning platform completions

- Role histories

- Collaboration data

This creates richer capability profiles that evolve over time.

For example, an operations manager who led a cross-functional automation initiative may not list “process automation strategy” explicitly. A skills graph can infer that capability from project metadata and outcomes. This allows the talent marketplace to surface non-obvious matches that a title-based system would miss.

Adjacency Mapping: Unlocking Hidden Mobility

One of the most powerful elements of the skills graph is adjacency intelligence.

Skills rarely exist in isolation. Data visualization connects to storytelling. Supply chain analytics connects to forecasting. Customer success connects to product enablement. A well-structured graph maps these relationships.

This allows organizations to identify:

- Lateral mobility pathways

- Reskilling feasibility

- High-potential internal candidates

- Emerging capability clusters

Instead of asking, “Who has done this exact job before?” the marketplace can ask, “Who has 70–80% of the required capabilities and can close the remaining gap quickly?”

That shift dramatically expands the viable internal talent pool.

Real-Time Evolution

The most advanced skills graphs are not static. They continuously update as:

- Employees complete new training

- AI-related capabilities emerge

- Projects generate new competency signals

- Market demand shifts

When integrated with external labor market analytics, organizations can compare internal supply with external demand trends. This transforms the talent marketplace from a mobility engine into a strategic workforce intelligence layer.

In 2026, the competitive advantage no longer lies in simply having a marketplace platform. It lies in the depth, accuracy, and adaptability of the skills graph that powers it.

Talent Marketplace & Workforce Planning Integration

The next phase of the talent marketplace is not about mobility alone — it is about integration with strategic workforce planning.

Historically, workforce planning and internal mobility operated in separate lanes.

Workforce planning asked:

- What roles do we need next year?

- Where will demand increase?

- What is our hiring forecast?

Internal mobility focused on:

- Who can move now?

- What roles are open?

- How do we fill vacancies faster?

In 2026, those questions are converging.

From Demand Forecasting to Supply Visibility

Modern workforce planning cannot rely purely on external hiring assumptions. Talent shortages, AI disruption, and budget pressure make external supply unpredictable and expensive.

When a talent marketplace integrates with workforce planning systems, organizations gain real-time internal supply visibility. Instead of forecasting demand in isolation, leaders can see:

- Current internal skill distribution

- Adjacent capabilities that could be reskilled

- Geographic skill concentrations

- Bench strength in critical role families

This changes planning from reactive to strategic.

For example, if workforce forecasts show rising demand for AI governance specialists, planning teams can assess:

- How many employees already possess compliance + data + AI literacy capabilities?

- What is the reskilling timeline?

- What proportion of demand can be met internally before external hiring becomes necessary?

This level of clarity dramatically improves decision quality.

Build, Buy, Borrow — With Data

The classic workforce strategy model — build, buy, borrow, bot — becomes far more precise when powered by a talent marketplace.

Instead of making assumptions about internal capacity, organizations can calculate:

- Build: What percentage of required skills can be developed internally within 6–12 months?

- Buy: Where are external labor markets stronger or more cost-effective?

- Borrow: Which short-term projects can be staffed internally through gig-style assignments?

- Bot: Which capability gaps can be partially automated?

The marketplace provides the internal capability map needed to make these calls confidently.

Closing the Loop With External Labor Market Data

When marketplace data integrates with labor market intelligence, the insight deepens further.

Organizations can compare:

- Internal skills supply vs. external talent availability

- Internal compensation bands vs. market benchmarks

- Emerging skills demand externally vs. internal readiness

This helps workforce planners answer a critical question:

Should we redeploy, reskill, or recruit?

The talent marketplace becomes not just a mobility tool, but a strategic workforce optimization engine.

Moving From Headcount Planning to Capability Planning

The biggest shift is conceptual.

Traditional workforce planning revolves around headcount.

Marketplace-integrated planning revolves around capability density.

Instead of asking:

“Do we need 25 more analysts?”

Organizations ask:

“Do we have sufficient analytical capability across priority initiatives?”

This shift reduces unnecessary hiring, improves internal utilization, and aligns workforce investments with real business demand.

In 2026, the enterprises gaining competitive advantage are those that connect their talent marketplace directly into workforce forecasting models — creating a closed loop between internal capability supply and future demand.

The Talent Marketplace Moment

The unified adoption of AI, advanced skills-based hiring, and the demands of a hybrid workplace creates a perfect scenario for deploying talent marketplaces. Considering that 81% of organizations have adopted skills-based hiring and 75% have begun AI literacy initiatives, the groundwork for talent marketplace success is already laid. Change is already being instituted, however organizations are still cautiously observing how marketplace ecosystems evolve. Gartner’s prediction of 35% enterprise-level adoption by 2027 indicates that a shift is on the horizon.

The transformation is purely organizational agility driven, meaning that adopted early action stands to gain impressive organizational responsiveness and retention. For early action advocates, Talent optimization, project deployment responsiveness improvement, and retention improvement are the immediate wins. For the tail-end action advocates, organizational efficiency and agility responsiveness are drastically reduced alongside a steep jump in Talent Acquisitions expenses.

The talent marketplace efficiency signals for 2025 are now confirmed. The technology is now matured, return on investment is tangible, effective, and measurable. Now is the perfect time to exploit structures around talent.

Gain access to job-market analytics to identify critical internal skills gaps, track prospects, and streamline talent-to-role alignment. Check out our solutions to see how JobPikr transforms market signals into measurable ROI, improves retention, reveals hidden talent pools, and reduces time-to-fill.

Want to see it in action? Get started today.

Turn Market Signals Into Internal Mobility Strategy

ee how JobsPikr helps you map skills supply, forecast gaps, and accelerate marketplace ROI.

FAQs

What is a talent marketplace?

A talent marketplace is an AI-powered platform that matches employees to internal roles, projects, gigs, and development opportunities based on verified skills and career aspirations.

How does a talent marketplace differ from an ATS?

An ATS manages external recruitment workflows. A talent marketplace focuses on internal mobility and skills-based matching, often integrating with ATS systems for hybrid sourcing.

How does a talent marketplace work?

A well-structured talent marketplace integrates employee skills, experience, and even aspirations from various blocks like the learning and performance data system, HR systems, and many more to create a single consolidated profile. As an example, role-specific short projects are consolidated at different cycles, whereby through AI and algorithmic driven systems, a match on a consolidated employee profile automatically renders a list of suitable participants. Business leaders receive prompts on suitable internal participants from the system and the employees are exposed to a curated list of milestones that help articulate revised learning objectives geared towards prior role previews.

What is the talent marketplace profile?

A talent marketplace profile is an example of modern IT which combines the diverse employee talent on an IT platform. It contains verified skills and certificates, work history, projects, learning achievements, and even unfulfilled career objectives. Proper management of the profile by employees and their immediate bosses greatly affects the skills match generated by the system and can lead towards a progressive workplace if the profiles are constantly updated.

What are the disadvantages of a talent marketplace?

Weak change management may result in low adoption, bias risk in AI matching incurs bias risk, algorithm integration with existing HR tech stacks, and complex integration. Without governance, up-to-date skills maintenance becomes impossible, and equal access to opportunities becomes impossible. In addition, organizational success hinges on strong external leadership, and a culture supportive of chronic internal mobility.

Where to find a list of competitors in the talent market?

Through HR technology analyst reports, industry publications, and specialized HR tech market maps, marketplaces and talent competitors become accessible. Annual publications by consulting firms showcase marketplace platforms and the competitive marketplace ecosystem. These reports feature not only established vendors, but also rising stars in mobility, skills intelligence, AI driven career development areas, and innovators of internal talent mobility.