- **TL;DR**

- How Is Retail Hiring Really Trending Before Black Friday 2025?

- How Did Black Friday Hiring Look in Previous Years? (2022 to 2024 Trends You Can’t Ignore)

- What Will Drive Retail Hiring Trends for Black Friday 2025?

- Get Early Access to Our Black Friday Discount

- Why Retailers Need Better Talent Intelligence in 2025

- How Job Data Trains Smarter Workforce Models for Retail (And Why Schema Design Matters)

- What Should Retailers Track Heading Into Black Friday 2025?

- Get Early Access to Our Black Friday Discount

- What This Means for Retail Leaders Preparing for Black Friday 2025

- The Real Message Behind Four Years of Retail Hiring Data

- Get Early Access to Our Black Friday Discount

-

FAQs

- 1. Which retail skills will be most important for Black Friday 2025?

- 2. How does job data improve workforce planning for peak season?

- 3. Why are hiring windows so short in 2025?

- 4. How should retailers adjust their hiring timeline for Black Friday 2025?

- 5. What does the drop in posting volume mean for retail hiring teams?

**TL;DR**

If you work in retail hiring, Black Friday 2025 will not feel like the last three years. There are fewer retail job postings in the run-up to peak season, and the roles that do go live are getting filled much faster. You have a smaller window to spot demand and act.

The mix of skills is shifting, too. Retailers are asking more for customer service, training, communication, and inventory skills, and a little less for broad, old-school sales and generic merchandising. That is a sign that the real pressure is on smooth store operations, fast fulfillment, and consistent customer experience, not just packing more people into front-of-house roles.

In this article, we use JobsPikr job data to unpack how retail hiring has moved since 2022, what is different heading into Black Friday 2025, and how talent intelligence can help workforce teams plan staffing levels, locations, and skills with a bit more confidence instead of guesswork.

How Is Retail Hiring Really Trending Before Black Friday 2025?

Retail hiring going into Black Friday 2025 is running lean. There are still seasonal spikes, but the overall pool of open roles is smaller, and the market clears faster than it did a few years ago. The JobsPikr data from 2022 to 2025 makes that very clear.

What does the JobsPikr data say about Black Friday posting volumes from 2022 to 2025?

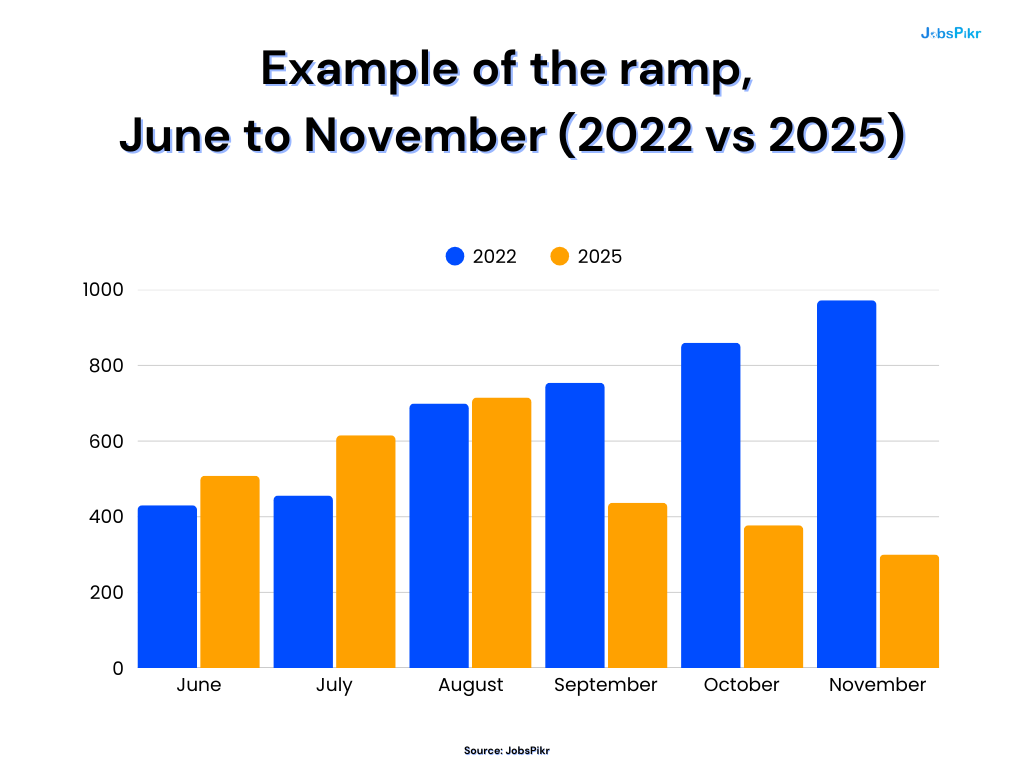

If you look only at October and November, you can see how quickly the market has cooled.

From this:

- November drops from about 972K postings in 2022 to roughly 665K in 2023, a fall of about 31.6 percent year on year.

- It falls again in 2024, to around 467K, which is another drop of about 29.7 percent.

- By November 2025, you are looking at roughly 300K postings, down about 35.7 percent from 2024.

October follows the same pattern. There is a smaller dip from 2022 to 2023, then a sharper decline into 2024 and an even steeper fall by 2025. Overall, the seasonal spike is still there, but it is sitting on a much lower base than in 2022.

You can also see that the ramp-up into peak season is changing shape. In 2022 and 2023, the jump from summer to pre-Black Friday months is very strong. In 2024 and 2025, the build up is flatter and more cautious.

In 2022, you get a clear climb from June all the way into November. In 2025, the story is different. June to August look healthy, then September, October, and November all step down instead of up. That is a strong signal that retailers are pulling some hiring earlier in the year and are more restrained as they get closer to Black Friday.

Why do shorter posting windows change how retail hiring works?

Volume is one side of the story. Speed is the other.

In 2022 and 2023, the average is extremely long. By 2024, it is already almost cut in half. By 2025, you are down to roughly two months.

Even if you discount older, legacy postings in the early years, the direction is clear. Retail roles are cycling through much faster in 2025. For a hiring team, that means you have:

- Less time between posting a role and losing good candidates to someone else.

- Less room for slow approvals or unclear headcount.

- A much tighter window to secure staff before Black Friday hits.

This is happening while the big employers are still very active. Walmart, Dollar General, Kroger, Walgreens, Starbucks, and others show up every year in the JobsPikr data, and by 2025 you also see names like Lensa and Love’s Travel Stops in the top group. That means more types of organisations are chasing similar frontline skills in the same short time frame.

So by the time you get to Black Friday 2025, you are working in a market with fewer postings, shorter posting windows,and more competition for the same talent pool. That is the baseline context we will build on when we start talking about skills, retail hiring trends and talent intelligence for workforce planning.

CTA: Get Early Access to Our Black Friday Discount

Our Black Friday offer starts on 28 November with 20 percent off all annual JobsPikr plans.

Claim 20% Off Annual Plans

How Did Black Friday Hiring Look in Previous Years? (2022 to 2024 Trends You Can’t Ignore)

To understand where retail hiring is headed in 2025, you have to look at how the market behaved in the previous three Black Friday cycles. The JobsPikr data shows three clear patterns across 2022, 2023, and 2024:

- Posting volumes peaked early and then softened year after year.

- The roles themselves shifted toward more operational work.

- Locations kept rotating as retailers adjusted to footfall changes and omni-channel pressure.

Let’s break it down clearly.

Which retail roles actually spiked during Black Friday season?

Across three years, the strongest demand always fell into a familiar group, but the ranking and volume shifted.

The big story here is the gradual cooling of both supervisor and front-line sales roles. Cashier demand grows in 2023 and remains high in 2024, aligning with a rise in hybrid checkout, click-and-collect, and in-store returns.

Another important shift is the steady drop in merchandising roles. Visual merchandising still matters during Black Friday, but in 2024, employers put far more weight on operational skills, fulfillment, and direct customer support.

How did hiring locations rotate as peak season shifted?

The top markets did not stay static. Retailers kept adjusting where they hired most, based on store activity, fulfilment demand and local competitiveness.

The interesting outlier is New York. It dominates in 2022 and 2023, then drops out of the top ten entirely in 2024. That tells you something shifted in local hiring patterns for that year. It could be wage pressure, saturation, increased remote or hybrid fulfilment elsewhere, or simply a strategic redistribution of seasonal headcount. The important part is that the market was not stable, and retailers had to respond to these shifts in real time.

What happened to wages over these three years?

Even with posting volumes sliding, advertised wages did not fall.

Wages hold steady in 2022 and 2023 and then increase slightly in 2024. This tracks with a job market where employers are competing for fewer applicants with the right skills, especially those who can handle fulfillment, customer service and in-store support.

What does all this mean for Black Friday hiring patterns?

If you zoom out, the three years before 2025 tell you that retail hiring has been shifting from volume-heavy to role-specific. Retailers posted more in 2022 and 2023, especially before the shopping peak, and then slowly cut back. Meanwhile, they concentrated demand into roles that directly handle operations, checkout, and customer experience.

Black Friday hiring did not disappear. It simply became more disciplined and more tied to real operational needs, rather than broad seasonal staffing.

The 2025 data continues in that direction, and the next section will break down the drivers behind it.

What Will Drive Retail Hiring Trends for Black Friday 2025?

By the time you reach 2025, the retail hiring market is not only smaller but also more selective and more skill-focused. The shift is not random. It is tied to the way retailers are running stores, fulfillment centers, and omnichannel operations during peak demand.

The JobsPikr data shows clear signals across four areas:

- Posting volumes are stabilising earlier in the year.

- The mix of soft and hard skills is changing direction.

- Retailers are prioritising operations and customer experience rather than pure sales.

- Seasonal hiring is happening earlier than most talent teams expect.

Let’s walk through what is shaping Black Friday hiring this year.

What does the 2025 trendline tell us about seasonal demand?

2025 looks different from the previous cycles because the strongest months are not in autumn. Summer months, especially June to August, carry the weight of retail hiring, while the typical pre Black Friday ramp slows down.

Three things stand out:

- Hiring peaks in August, not in October or November.

- September sees a sharp drop, which continues into the Black Friday months.

- Retailers are clearly pulling some seasonal hiring forward rather than waiting.

This early movement aligns with the rise of omni-channel shopping, where peak demand starts long before Black Friday weekend. Early promotions, staged inventory drops, and phased fulfilment make a single hiring spike less effective, so teams distribute hiring earlier in the year.

Which soft skills matter most for retail in 2025?

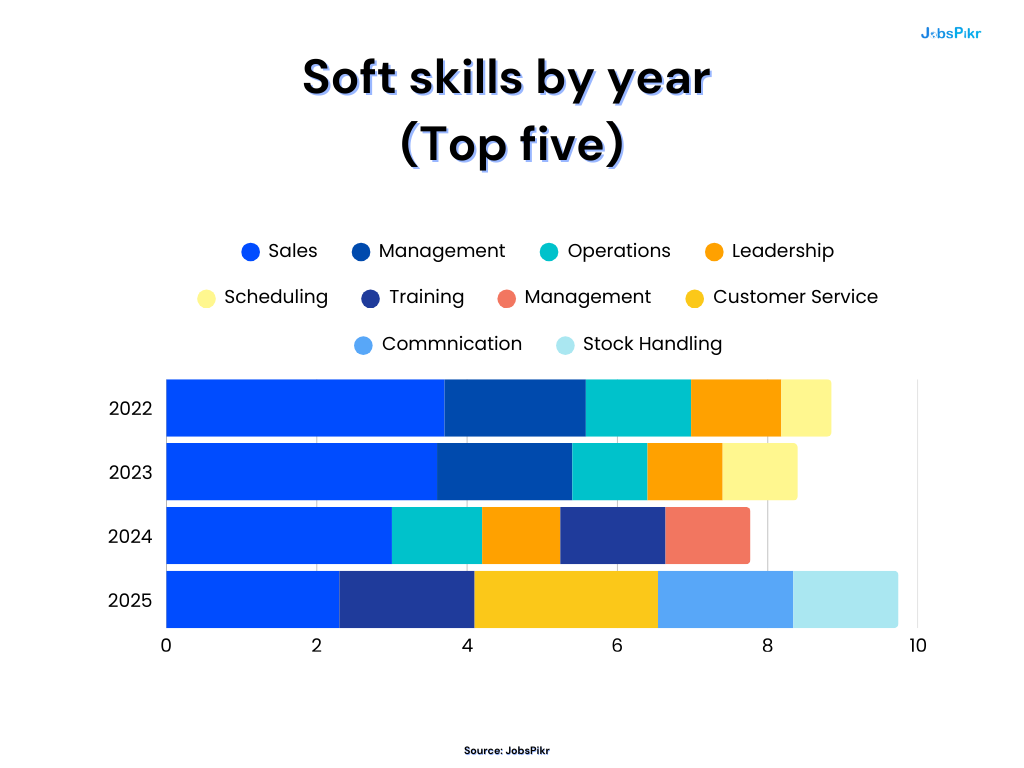

When you compare soft skill demand across four years, you can see how retail jobs have evolved.

The shift from 2022 to 2025 is clear:

- Training, communication, and customer service jump sharply in 2024 and 2025.

- Sales and management drop from the top of the list, replaced by skills that support operations.

- Stock handling enters the top group for the first time in 2025.

This shift reflects the complexity of modern retail. Employees need to move between store, inventory, and fulfilment tasks. They need stronger communication skills for digital and in-person interactions, and they need to smoothly handle pickup, returns, and customer service flows.

Sales alone are no longer the center of seasonal hiring. The data shows retailers are looking for adaptable, cross-functional teams.

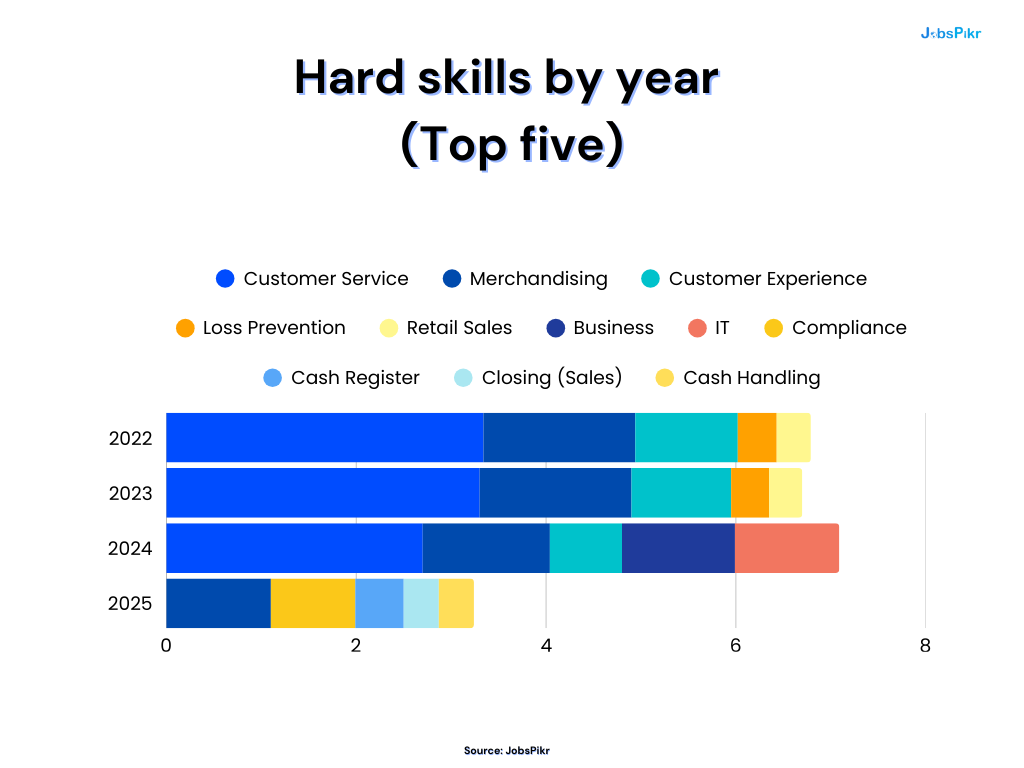

What hard skills are shaping retail hiring in 2025?

Hard skills reinforce the same pattern.

Here is what changes:

- Customer service is still present, but not as dominant.

- Compliance, cash handling, and register operation become much more important in 2025.

- Skills tied to the operational side of peak season rise sharply.

This lines up with a Black Friday cycle where customer flow is unpredictable, payment volumes surge and retailers want employees who can switch between floor assistance, payment support, fulfilment and returns.

Why does this matter for Black Friday 2025?

Black Friday is now a multi-week event rather than a two-day rush. Promotions start earlier. Inventory turns faster. Fulfillment pressure builds before footfall peaks.

The skill shift and early posting pattern both point to one thing. Retailers need teams who can keep operations moving in high-pressure environments, not just close sales.

That is the backdrop for why talent intelligence and job data matter so much in the next section. Retailers cannot plan for Black Friday 2025 based on guesswork. They need to understand which roles will appear, how long they will stay open and what skills they cannot afford to be short on.

Get Early Access to Our Black Friday Discount

Our Black Friday offer starts on 28 November with 20 percent off all annual JobsPikr plans.

Why Retailers Need Better Talent Intelligence in 2025

Retail hiring for Black Friday has always required some level of planning, but the 2025 market raises the stakes. When posting volumes fall, skills shift, and roles move through the market in weeks rather than months, you cannot rely on historical instincts or store-level guesswork. You need workforce signals that arrive early and make sense quickly.

This is where talent intelligence, powered by job posting data, becomes a real advantage. The JobsPikr dataset shows how employer behaviour, location shifts and job requirements have changed enough to make older hiring playbooks unreliable for 2025.

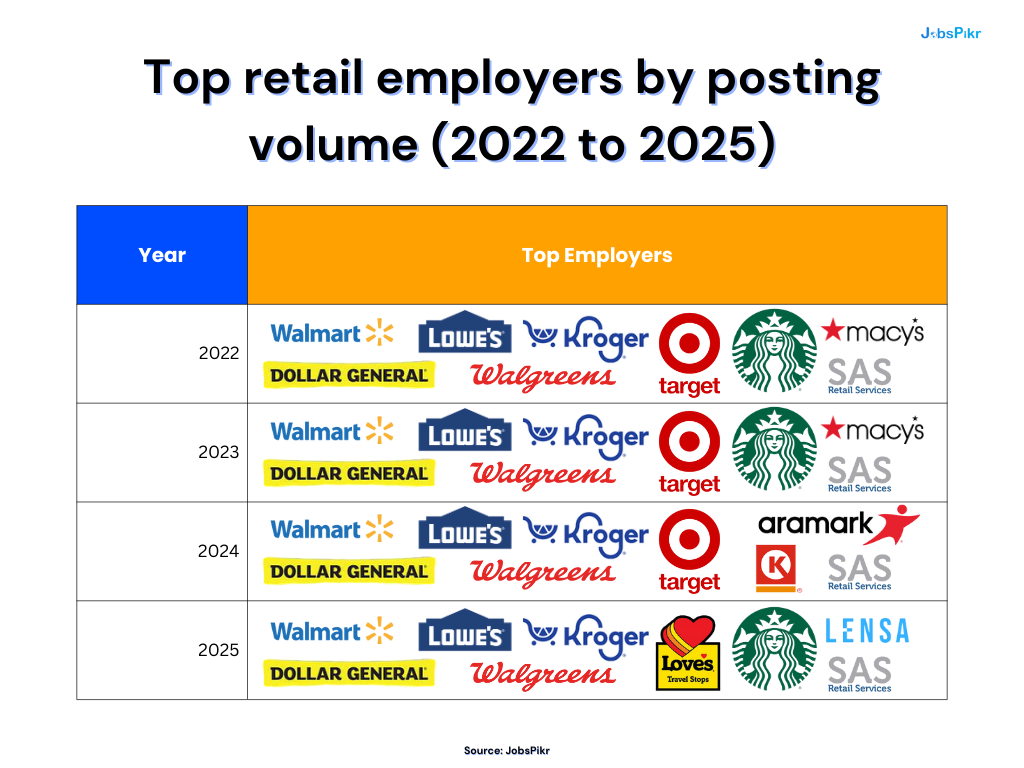

Which companies are driving demand in the lead-up to Black Friday?

The top employers from 2022 to 2025 tell a useful story. You see a few names appear repeatedly, but you also see unexpected entrants gaining ground in the most recent year.

The stability at the top is expected. Large national chains maintain consistent seasonal hiring needs. What matters more is the movement around them.

Lensa and Love’s Travel Stops entering the top ten in 2025 is a sign that more types of businesses are competing for the same frontline talent pool. It is no longer only big box retailers or grocery chains posting aggressively before Black Friday. Service-driven brands and hiring platforms are active too, which increases competition in markets that already have shrinking posting volume.

What does repeat posting behaviour tell workforce teams?

When the same employers appear year after year with high posting volumes, it usually signals that those companies rely heavily on seasonal or high-turnover roles. Walmart, Dollar General, Lowe’s, Walgreens, Kroger, and Starbucks fit this profile in every year from 2022 to 2025.

For workforce planners, this means two things:

- You are competing with brands that hire early and consistently.

- You cannot afford to wait until the usual October or November push to begin allocating headcount.

The drop in posting duration to roughly sixty days in 2025 emphasises this even more. If large employers are closing roles quickly, they will capture talent long before slower organisations even finalise their Black Friday budgets.

Where do sudden posting surges show up?

Looking at the employer list from 2024 to 2025, Aramark remains, but Circle K drops out and Love’s Travel Stops enters. This type of rotation usually signals shifting demand in specific states or regions.

Love’s, for example, has strong presence in Texas, Oklahoma, Arkansas and parts of the Midwest. If they ramp up hiring in 2025, that directly affects markets where traditional retailers already struggle to attract frontline workers. In cities like Dallas, Houston or Columbus, where demand is consistently high, a new employer aggressively posting into peak season can tighten the market further.

These employer-based signals are exactly the type of detail hiring teams need to avoid understaffing. They are not visible in store-level reports or general labour market updates but appear immediately in job data.

Why does talent intelligence matter for Black Friday 2025 hiring?

If you look at all the trends together, retail hiring in 2025 is defined by:

- Lower seasonal posting volume

- Earlier spikes in demand

- Faster posting cycles

- A shift toward operational and customer experience skills

- More employers are competing in the same markets

That mix creates a planning challenge. Relying on last year’s assumptions is risky. Workforce teams need data that can show which roles are heating up, where employer competition is rising, and which skills will be difficult to secure at scale.

This is why job posting intelligence is no longer a “nice to have” for Black Friday hiring. It is the only source that shows hiring intent in real time, rather than after stores feel the pain. With clean and structured job data, retailers can see the trends early enough to act on them, adjust their hiring timing, and pick the right locations for seasonal staffing.

Now that we have covered demand and employer behaviour, the next section explains how job data actually supports forecasting and how smarter workforce models depend on clean retail schemas.

How Job Data Trains Smarter Workforce Models for Retail (And Why Schema Design Matters)

Most retail teams agree that hiring for Black Friday feels harder every year. The drop in posting volume, the shorter posting windows and the shift in skills all add pressure. But what often gets missed is this: you cannot plan for any of it without clean, structured job data.

A workforce model is only as good as the signals it learns from. If the underlying job data is messy, inconsistent or poorly structured, the model will misread demand, misjudge skill gaps and produce forecasts that don’t match what stores actually face on the ground. This is where schema design becomes just as important as the data itself.

What makes job data “AI-ready” for retail workforce planning?

Retail job postings are messy by default. Employers describe the same role in dozens of ways. Skills are mixed into long paragraphs. Salary fields vary across states. Locations show up as neighbourhoods, cities, or store numbers. Without a proper schema, those signals never translate into clean patterns.

A retail dataset becomes AI-ready only when each posting is broken into well-defined fields that models can understand. In the JobsPikr retail schema, the core fields include:

- Job title

- Job description text

- Skills extracted from the description

- Location (city, state, latitude and longitude when available)

- Salary or wage information

- Posting date and last seen date

- Employer name

- Job type (full-time, part-time, temporary or seasonal)

These fields give you consistency. Once the structure is predictable, the model can actually detect patterns such as short-term spikes, location tightness or role rotation across seasons.

How does schema quality affect hiring forecasts?

A clean schema does three things that directly improve workforce planning.

First, it reduces noise. When retail postings are scattered across inconsistent titles such as “Cashier,” “Cashier FT,” “Front End Team Member,” and “Guest Checkout Associate,” the model cannot recognise that they are the same underlying role. Schema-based title standardisation solves this by mapping all variants to a clear category. That means your model sees real trends, not fragmented versions of them.

Second, it keeps skill signals accurate. Retail job descriptions often list dozens of responsibilities, but only a few are actual skills. Schema-driven skill extraction identifies real skills such as customer service, communication, stock handling, or compliance and separates them from generic phrasing. When the model learns from those extracted skills instead of raw text, its predictions about future hiring needs are far more reliable.

Third, it prevents inflation from duplicate postings. Retailers often repost the same role or list a single job across multiple boards. Without normalisation, those duplicates make it look like demand is higher than it is. Schema-based deduplication removes repeats and keeps the count honest. Workforce teams relying on that data get a realistic view instead of an exaggerated one.

What does data normalisation look like in practice?

Here is how normalisation improves data quality inside a retail hiring dataset:

- Title standardisation

A posting listed as “Customer Service Specialist,” another as “Customer Experience Associate” and another as “Sales Floor Support” can all map to a single category if they share the same core responsibilities. Once normalised, the model sees a clear rise or fall in that role instead of three weak signals.

- Skill extraction

If a description says “must assist with customer questions, checkout issues, returns and general support,” the model does not treat that as long text. It extracts “customer service,” “checkout support” and “returns handling” as structured skills that can be tracked over time.

- Duplicate elimination

If Walmart posts the same cashier role in Houston across multiple job boards, schema rules identify overlapping text, location and employer to collapse them into one job. Trends become far clearer.

- Schema updates improving accuracy

When retailers start adding new responsibilities such as curbside pickup or digital order support, the schema can incorporate new skill categories. That helps the model understand market shifts earlier instead of misclassifying them as noise.

Normalisation is not just a technical improvement. It changes how accurately workforce teams can plan headcount, understand skill gaps or prepare stores for demand spikes. For Black Friday 2025, this is crucial because the hiring window is short and the margin for error is smaller than previous years.

How do retailers benefit when their workforce models run on clean job data?

When job data is structured and clean, a workforce model can answer questions that matter directly to seasonal planning, such as:

- Which roles fill fastest in specific cities?

- When does seasonal demand start rising each year?

- Which skills are becoming harder to find?

- Which employers are heating up the market before Black Friday?

- Where are wage pressures likely to appear next?

With accurate answers, retailers avoid the two biggest problems of peak season hiring: overstaffing stores that did not need it and understaffing stores that get hit by unexpected traffic or fulfillment pressure.

The bottom line is simple. You cannot build a useful workforce model with unstructured job postings. Schema design and data quality turn ambiguous hiring signals into something a model can learn from. In a year like 2025, where demand is unpredictable and talent moves quickly, this becomes one of the most reliable ways a retailer can prepare for Black Friday.

In the next section, we will link all of this to the metrics retailers should actually monitor as the holiday season approaches.

What Should Retailers Track Heading Into Black Friday 2025?

Once you understand the shifts in roles, skills and employer behaviour, the next question is simple. What should retail hiring teams actually track in the run-up to Black Friday 2025? The answer depends on three things: which skills are rising or fading, where competition is getting tight and when seasonal demand starts building before stores feel it.

The JobsPikr data gives a clear view of these signals. When you look at several years together, a pattern emerges that helps retail teams avoid last-minute hiring scrambles and misjudged staffing levels.

Which retail skills show the strongest signals heading into peak season?

Skill demand is one of the earliest indicators of what Black Friday hiring will look like. The mix of soft and hard skills between 2022 and 2025 shows exactly how much retail operations have changed.

Top soft skills by year (2022 to 2025)

| Year | Top Soft Skills |

| 2022 | Sales (3.7M), Management (1.88M), Operations (1.42M), Leadership (1.24M), Scheduling (672K) |

| 2023 | Sales (3.6M), Management (1.87M), Operations (1.42M), Leadership (1.23M), Scheduling (672K) |

| 2024 | Sales (3.07M), Training (1.42M), Operations (1.22M), Management (1.13M), Leadership (1.04M) |

| 2025 | Customer Service (2.44M), Sales (2.34M), Training (1.89M), Communication (1.86M), Stock Handling (1.4M) |

What matters here is not just what goes up but what replaces it. Customer service moves to the top in 2025, followed closely by training and communication. These are not nice to have abilities. They show up when retailers expect frequent customer interactions, complex fulfilment flows, and high volume return traffic.

Stock handling’s rise also shows how critical inventory accuracy has become during peak season. When pickup and delivery timelines shrink, even small errors can ripple across store operations.

Hard skills reinforce the same story.

Top hard skills by year (2022 to 2025)

| Year | Top Hard Skills |

| 2022 | Customer Service (3.34M), Merchandising (1.6M), Customer Experience (1.08M), Loss Prevention (401K), Retail Sales (359K) |

| 2023 | Customer Service (3.33M), Merchandising (1.6M), Customer Experience (1.08M), Loss Prevention (400K), Retail Sales (358K) |

| 2024 | Customer Service (2.7M), Merchandising (1.34M), Business (1.19M), IT (1.1M), Customer Experience (759K) |

| 2025 | Merchandising (1.12M), Compliance (894K), Cash Register (514K), Closing (Sales) (377K), Cash Handling (372K) |

In 2025, compliance, register operation and cash handling rise sharply. This reflects more complex transaction volumes, higher risk in fast-moving environments and the need for employees who can handle sensitive tasks during periods of heavy traffic.

For hiring teams, these skill movements are early warning signs. They show where the labour market will tighten first and which stores or regions may feel staffing pressure ahead of Black Friday.

Should retailers watch for location-based hiring spikes?

Location trends are another measurable signal. From 2022 to 2024, the top hiring cities rotated more than most people expect. Markets like Columbus, Charlotte, Jacksonville, and Las Vegas moved up and down depending on employer behaviour, fulfillment needs, and regional demand shifts.

By 2025, the top locations will stabilise into a mix of large metros and high-throughput markets.

Top hiring locations in 2025

New York, Houston, Atlanta, Dallas, Columbus, Chicago, Charlotte, Phoenix, Los Angeles and Austin.

The interesting part is that New York, which dropped out entirely in 2024, climbs back to the top in 2025. That rebound could signal:

- new store activity

- stronger fulfilment demand

- wage adjustments pulling talent back

- competitive pressure from new employers in nearby regions

When a major market like New York moves sharply in or out of the top ten, it is usually an early sign of hiring disruptions. Workforce teams in those cities should be watching not just volumes but the mix of roles and skills appearing each month.

When does seasonal demand usually start building?

The clearest trend in the JobsPikr data is that seasonal hiring starts earlier than most teams assume. Across 2023, 2024 and 2025, August consistently shows strong activity. In 2025, August is the highest month of the year at around 715K postings.

This early spike tells you that retailers are preparing for a longer holiday season that starts well before Black Friday weekend. Promotions and early deals push customer traffic higher in September, not November. That means hiring late is risky.

If your competitors begin hiring seasonal teams in August and you wait until October, you are already behind the market. You may still fill roles, but likely at higher cost or with less experienced talent.

What does this mean for hiring teams planning for Black Friday 2025?

Retailers heading into this season cannot afford to treat hiring as a last minute effort. The signals from the last four years are clear:

- Skills tied to customer interaction, training and inventory are rising.

- Hard skills around compliance and payment handling are becoming more important.

- Seasonal roles appear earlier than expected.

- Location patterns shift enough that planning needs to be dynamic.

These are all measurable signals. With structured job data, teams can track them weekly instead of waiting for problems to surface in stores.

Get Early Access to Our Black Friday Discount

Our Black Friday offer starts on 28 November with 20 percent off all annual JobsPikr plans.

What This Means for Retail Leaders Preparing for Black Friday 2025

By now, the picture is clear. Retail hiring in 2025 is not disappearing. It is tightening. The volume of postings is lower, roles move faster, and the skills retailers need are more precise than they were even two years ago. This changes how leaders should think about staffing, training and workforce timing for the holiday season.

The data points to three practical takeaways that matter more than anything else.

Hiring later in the season is a disadvantage now

The JobsPikr trendline for 2025 shows the strongest hiring months happening in June, July and especially August. After that, the market cools. If you wait until October or November, you are stepping into the market long after the peak. Your competitors have already hired, training has already begun and the available talent pool is smaller.

There is still a Black Friday spike, but it is smaller than in previous years. Relying on that spike alone leaves stores unprepared and fulfilment teams overwhelmed.

For leaders, the most important shift is to make hiring decisions much earlier. Even a few weeks of delay can put you behind competitors who are watching the same signals and acting faster.

Skills matter more than headcount

The retail skills that rise and fall between 2022 and 2025 tell a larger story. Customer service, communication, training, and inventory handling are the skills that grow. These are not optional. They directly affect in-store experience, digital order fulfilment, queue management, returns handling and customer satisfaction during peak season.

On the hard skill side, register operation, compliance and cash handling show stronger demand in 2025. These are pressure points during Black Friday, when transaction volume can double and error rates become costly.

In other words, headcount without the right skills is not enough. Workforce planning for 2025 needs to focus on the specific capabilities that keep stores and fulfilment operations steady under unpredictable traffic.

Workforce teams need earlier and clearer hiring signals

Across all the years, the biggest advantage job data gives retailers is visibility. When you know which cities are heating up, which employers are posting aggressively, and which roles are filling in under sixty days, you avoid being surprised by sudden staffing gaps.

The challenge for retailers is that none of these signals show up in store reporting or general market summaries. They show up in the job market first. If leadership teams want to avoid last-minute scrambling in October or early November, they need talent intelligence tools that reveal these patterns as they happen.

With real-time job data, leaders can:

- Adjust hiring timelines

- Allocate budget to the right cities

- track which skills will be hardest to hire

- understand where competition is increasing

- Reduce both overstaffing and understaffing risk

This kind of planning is especially important for omnichannel retail, where customer experience depends on everything working together, not just the store floor.

The Real Message Behind Four Years of Retail Hiring Data

If you step back from the numbers and look at the full arc from 2022 to 2025, the lesson for retail leaders is simple. Seasonal hiring is no longer a rush. It is a long game. The retailers who are prepared for Black Friday 2025 will not be the ones who hire the most people. They will be the ones who read the signals early, understand what the market is tightening around and act before the crowd moves.

The drop in posting volumes tells you the market is getting leaner. The shift in skills tells you stores and fulfilment centres are running more complex workflows than before. The shorter posting windows show that talent is moving quickly and that slow approvals will cost you candidates, long before November arrives.

You cannot solve these problems with guesswork or delayed hiring cycles. You solve them by watching job data like a live feed. When you see August demand as the real start of seasonal preparation, when you notice employers entering or leaving key cities and when you understand which skills appear in job descriptions before they show up in store feedback, you get the advantage.

Black Friday 2025 will be busy, but it will not reward late movers. It will reward teams that use clear signals, structured job data, and steady planning to build the right workforce ahead of time. With the right intelligence, seasonal hiring becomes predictable again, even in a market that keeps changing.

Get Early Access to Our Black Friday Discount

Our Black Friday offer starts on 28 November with 20 percent off all annual JobsPikr plans.

FAQs

1. Which retail skills will be most important for Black Friday 2025?

Black Friday this year is less about pure selling and more about keeping operations steady when footfall, online orders, and returns all peak at the same time. That is why customer service, communication, training, and stock handling show some of the strongest growth in 2025’s job postings. These are the skills that help teams manage long queues, smooth fulfilment, complicated order pickup flows, and the wave of same-day returns that now come with holiday shopping. On the hard-skill side, register operation, cash handling, and compliance matter because transaction volume climbs and errors get expensive fast. Retailers need people who can move confidently across these tasks without slowing the store down.

2. How does job data improve workforce planning for peak season?

Job data gives hiring teams a live view of market demand. Instead of guessing when competitors are hiring or which roles are tightening, you can see the shifts as they happen. The changes in posting volume, posting speed, location activity and skill demand all show up in job data before they show up in stores. That gives leaders a chance to bring hiring forward, budget correctly, and prepare training and onboarding well before Black Friday pressure hits. When roles are filled in sixty days, not six months, this early visibility becomes essential.

3. Why are hiring windows so short in 2025?

Retailers are far clearer about what they need this year. The mix of roles is more specific, and the market is more competitive, so employers close postings quickly when they find the right people. At the same time, the overall number of postings is lower, so workers move through the market faster. That combination makes long open postings rare. If a job goes live in September, you will likely need it filled by November. Slow approvals or fragmented hiring processes simply don’t fit the 2025 market.

4. How should retailers adjust their hiring timeline for Black Friday 2025?

The data shows that the real build-up to holiday staffing starts in August, not late October. Retailers who wait until the usual “seasonal rush” will be late. By then, many of the best candidates have already accepted roles with brands that hired earlier. The more effective approach is to treat summer as the beginning of seasonal planning. Decisions on headcount, markets, and budgets should be locked in before August if you want a realistic chance of securing the skills that will matter most during the holiday season.

5. What does the drop in posting volume mean for retail hiring teams?

Lower posting volume does not mean lower demand. It means retailers are being more disciplined about how many seasonal roles they put into the market and when they do it. With fewer postings and shorter posting windows, every hiring decision matters more. Stores cannot rely on overstaffing as a buffer. Workforce teams need sharper signals on skills, markets, and timing so they can get hiring right the first time. In a market this tight, mistakes are harder to fix once Black Friday traffic kicks in.