- Why Skill Gap Analysis Keeps Solving the Wrong Problems

- **TL;DR**

- Why Teams Still Feel Under-Skilled After Aggressive Hiring

- Turn Skill Gap Analysis into a Forward Signal

- Where The Most Costly Skill Gaps Form And Why They Stay Invisible

- Why Hidden Skill Trends Rarely Match Where Budgets Go

- Turn Skill Gap Analysis into a Forward Signal

- How Global Job Demand Creates Skill Gaps Local Data Cannot Explain

-

How JobsPikr Surfaces Skill Gaps Others Miss

- Job Postings Are Not Useful Until You Treat Them Like A Signal Stream

- Normalization Is What Makes Hidden Skill Trends Visible

- Trend Tracking Matters More Than “Top Skills This Month”

- Separating A Real Shift From A Temporary Spike

- It Connects External Demand To The Decisions Leaders Actually Need To Make

- Turn Skill Gap Analysis into a Forward Signal

- What Changes When Skill Gap Analysis Becomes An Intelligence System

- Skill Gaps Are Only Invisible When Leaders Stop Reading The Market

- Turn Skill Gap Analysis into a Forward Signal

- FAQs

Why Skill Gap Analysis Keeps Solving the Wrong Problems

**TL;DR**

Most skill gap analysis is busy measuring what your people learned last year while your teams are getting stuck on what the work needs this quarter. That is why leaders keep saying “we need more skilled people” even after hiring. The gap is not always about supply. It is about expectations changing inside roles, new responsibilities getting added quietly, and teams being asked to stitch systems, tools, and decisions together without the capabilities to do it cleanly.

The hidden skill trends are rarely the flashy ones you see in trending skills lists. They are the unglamorous skills that show up as “own the outcome,” “work cross-functionally,” “reduce risk,” “ship fast,” and “make calls with imperfect data.” You do not catch these early with internal frameworks alone. You catch them by watching job demand insights and global job demand move in real time.

That is what labor market insights are good for, they show you where the market is pulling skills next so your skill gap analysis can drive decisions, not just reporting. JobsPikr sits in that layer, turning raw postings into workforce intelligence you can use.

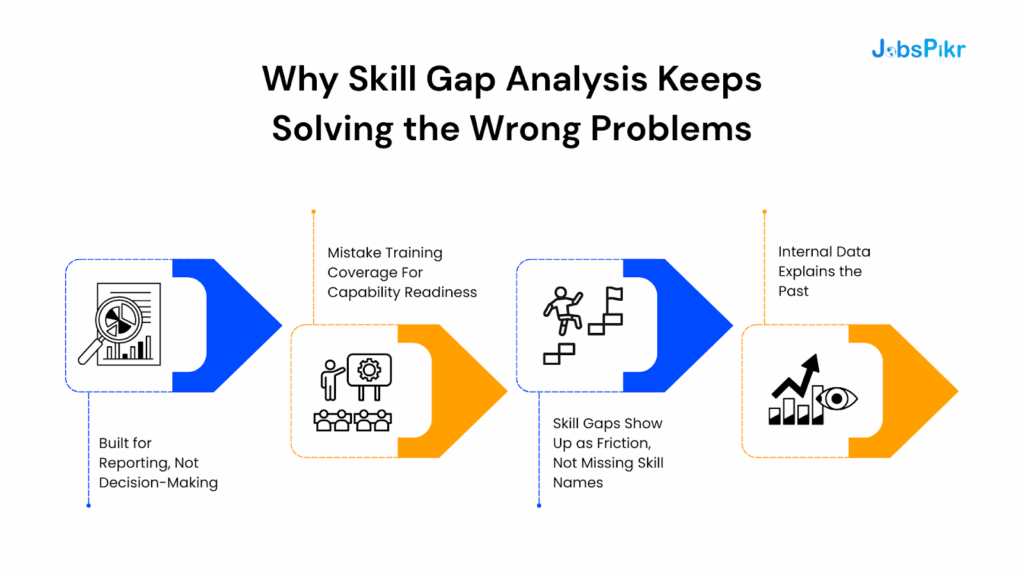

Most skill gap analysis fails for a simple reason. It looks neat on paper, but it is disconnected from how work happens. The result is a lot of activity around skills, training, and frameworks, while the real bottlenecks keep showing up elsewhere. This section breaks down where things go wrong.

Most Skill Gap Analysis Is Built for Reporting, Not Decision-Making

A lot of skill gap exercises are designed to be defensible, not useful. They answer questions that are easy to measure, not questions leaders need to act on.

Typically, they focus on things like:

- Whether a skill exists somewhere in the organization

- Whether people have completed a course or certification

- Whether roles map cleanly to a predefined framework

All of this helps with reporting and audits. Very little of it helps explain why execution is slowing down or why teams feel stretched despite “good coverage” on paper.

Leaders Mistake Training Coverage For Capability Readiness

This is where many teams get misled. High training completion creates a false sense of closure. It feels like the gap has been addressed.

Roles have often moved faster than the training itself. People may have learned the tool, but not how to:

- Make trade-offs when inputs conflict

- Coordinate across teams without clear ownership

- Take responsibility for outcomes instead of tasks

When these expectations shift quietly, training metrics stay green while capability gaps widen underneath.

Skill Gaps Show Up as Friction, Not Missing Skill Names

Real skill gaps rarely show up as obvious absences. Teams do not say, “we lack skill X.” Instead, the signals are operational.

You start seeing:

- Work bouncing between teams before decisions are made

- Senior leaders pulled into routine approvals

- Repeated rework because expectations were unclear

Traditional skill gap analysis does not catch this because it looks for named skills. Job demand insights catch it because job descriptions start encoding these expectations as responsibilities rather than skills.

Internal Data Explains the Past, While Job Demand Signals The Present

Internal systems are slow by nature. Resumes reflect experience. Learning plans reflect last quarter’s priorities. Performance reviews explain outcomes after the work is done.

Global job demand moves differently. When similar roles across markets begin asking for broader ownership, faster execution, or deeper judgment, that is not noise. That is the market adjusting expectations in real time. A skill gap analysis that ignores labor market insights will always be late, even if it is perfectly documented.

Skill Gap Reality Check

Why Teams Still Feel Under-Skilled After Aggressive Hiring

On paper, this is the most confusing situation for leaders. Headcount is up. Roles are filled. Hiring pipelines look healthy. And yet teams still feel stretched, slower, and less confident than before. This is usually the moment when skill gap analysis gets blamed again. The problem is not how many people you hired. It is what those roles quietly turned into after they were filled.

Hiring Fills Roles Faster Than Role Expectations Stabilize

Hiring closes vacancies. It does not freeze expectations. In many organizations, role scope keeps expanding even after the position is filled.

What happens looks like this:

- New tools get added to the stack, but ownership is unclear

- Cross-team coordination becomes part of the job without being formalized

- Speed, quality, and accountability expectations increase at the same time

Job titles stay the same. Leveling stays the same. But the work changes. When skill gap analysis only checks whether a role is staffed, it misses the fact that the role itself has shifted under the person doing it.

Skill Gaps Are Increasingly Forming Inside Filled Roles

This is the part most hiring metrics completely miss. Many of today’s skill gaps are not about unfilled positions. They are about underpowered roles.

People are hired for one version of the job and end up doing another. Over time, this creates a quiet mismatch between:

- What the role was designed to do

- What the market now expects that role to handle

Job demand insights make this visible. When job descriptions for the same role start including broader responsibility language across companies, that is not coincidence. It is a signal that the skill bar has moved, even if the org chart has not.

Hiring Volume Masks Expectation Inflation

Aggressive hiring can hide skill gaps instead of solving them. If roles are being filled quickly, the assumption is that capability is improving.

But expectation inflation shows up in subtler ways:

- Experience requirements creep up in new postings

- “Nice to have” skills quietly become default expectations

- Ownership language replaces task-based descriptions

Global job demand data shows this pattern clearly. Teams are not short on people. They are short on the skills required to operate in roles that have become more complex, more connected, and more accountable.

Why Job Demand Signals Surface Mismatch Earlier Than Attrition

Most organizations only recognize this mismatch when people burn out or leave. By then, the gap has already done damage.

Labor market insights catch the problem earlier. When similar roles across regions start asking for broader scope, deeper judgment, or faster execution, that is the market recalibrating expectations. Skill gap analysis that includes job demand insights helps leaders see that recalibration before it shows up as disengagement, quality issues, or attrition.

This is why teams can hire aggressively and still feel under-skilled. The issue is not supply. It is that the definition of “fully capable” has moved, and internal systems are still measuring against the old version of the job.

Turn Skill Gap Analysis into a Forward Signal

Use global labor market insights to spot role stretch and capability pressure before it becomes attrition or rework.

Where The Most Costly Skill Gaps Form And Why They Stay Invisible

If you want to find the skill gaps that actually hurt, stop looking at the loud stuff. Not the “we cannot hire” roles. Not the trendy skills list that changes every quarter. The costly gaps are quieter. They sit inside teams that look fine in a headcount report, and they show up as small delays and messy handoffs that everybody learns to tolerate.

Mid-Level Roles Are Doing The “Glue Work” Nobody Designed A Role For

A lot of modern organizations’ pain sits in the middle. Not at the top where strategy is set, and not at entry level where tasks are clearer. It sits with people who are expected to connect dots across tools, stakeholders, and shifting priorities.

What makes this tricky is that the work is real, but it is rarely named. It is not written as “system thinking” or “operational judgment.” It shows up as vague expectations like “drive alignment” or “own outcomes.” So the role expands, but the skills plan does not.

The tell is simple. When you see the same person acting as:

- translator between teams,

- traffic controller for decisions,

- and fallback problem-solver when things go sideways,

you are looking at a capability gap that the organization is papering over with effort.

These Gaps Show Up As Bottlenecks, Not As Missing Skills

Most companies try to locate skill gaps by asking, “what skills are we missing?” That question is too direct. People do not experience skill gaps as missing skills. They experience them as friction.

You see it in the weekly rhythm:

- Meetings multiply because decisions cannot land the first time.

- Work gets restarted because requirements were never properly shaped.

- A few senior folks become the approval layer for everything, even when they do not want to be.

None of that gets labeled as a skill issue. It gets labeled as “execution,” “communication,” or “cross-functional complexity.” That is exactly why it stays invisible in skill gap analysis.

“Assumed Skills” Are Where The Damage Hides The Longest

There’s a set of skills most organizations treat like background noise. Everyone is supposed to have them, so no one invests in them properly. They only get noticed when they are absent.

Examples that matter more than people admit:

- prioritization when everything is urgent,

- making decisions with incomplete data,

- writing and thinking clearly enough that others can act without another meeting,

- handling exceptions and edge cases without escalation.

These skills are boring to talk about and hard to quantify. But they are the difference between teams that move and teams that stall. Hidden skill trends often live right here. They do not look like a new tool or a new certification. They look like “better judgment at speed.”

Why These Gaps Rarely Trigger Action Until It Gets Expensive

If a role is unfilled, it is visible. If a skill is missing inside a filled role, it is easy to rationalize. People compensate. They work longer hours. They lean on one high performer. They add another sync. The org keeps moving, just slower and with more stress.

Then the costs show up later, and they feel disconnected:

- projects miss deadlines for reasons nobody can pin down,

- quality slips even when the team is experienced,

- attrition spikes in roles that were supposed to be stable,

- leadership complains about “lack of ownership” without realizing ownership was never enabled.

This is the core issue: the most costly gaps survive because the organization can temporarily brute-force through them. Skill gap analysis needs to get better at spotting these early, using job demand insights and labor market insights as a mirror. Otherwise you keep treating capability debt like a motivation problem.

Skill Gap Reality Check

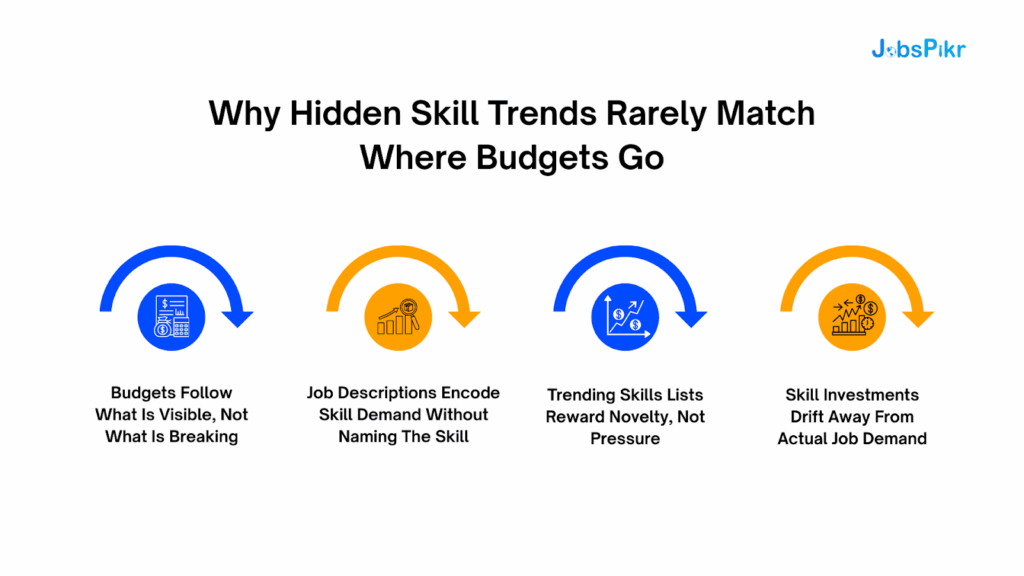

Why Hidden Skill Trends Rarely Match Where Budgets Go

This is where the disconnect becomes obvious. If you compare where most organizations spend their learning and hiring budgets with what job demand is actually signaling, the overlap is thinner than leaders expect. Money flows toward skills that are easy to name, easy to justify, and easy to defend. Pressure in the market builds somewhere else.

Budgets Follow What Is Visible, Not What Is Breaking

Skills that get funding usually have three things going for them. They are easy to explain to leadership. They come with vendors, certifications, or neat course catalogs. And they look future-facing in a slide deck.

Hidden skill trends do not behave like that. They show up as changes in how work needs to be done, not as new categories. You see more emphasis on ownership, coordination, and decision-making, but none of those come with a clean budget line. So they stay unfunded, even as demand for them rises across roles.

This is why skill gap analysis often feels disconnected from day-to-day pain. The analysis may be technically correct, but it is anchored to what the organization is already comfortable investing in.

Job Descriptions Encode Skill Demand Without Naming The Skill

One of the clearest signals of hidden skill trends sits inside job descriptions, not in skill frameworks. Employers rarely say “we need better judgment” or “we need stronger system thinking.” Instead, they describe outcomes.

You start seeing phrases like:

- “own end-to-end delivery,”

- “make trade-offs across competing priorities,”

- “operate with minimal guidance,”

- “manage ambiguity in fast-changing environments.”

None of these sound like skills in a traditional sense. But taken together, they describe a very specific capability profile. Job demand insights pick this up quickly because the language spreads across companies and regions. Internal planning often misses it because there is nothing obvious to tag or track.

Trending Skills Lists Reward Novelty, Not Pressure

There is a reason trending skills lists feel disconnected from reality. They are built to highlight what is new, not what is stressed. A skill can be under extreme pressure in the market without being new or exciting.

In global job demand data, many of the fastest-growing expectations are extensions of existing skills, not replacements. The role still exists. The tools may be familiar. What changes is the level of judgment, speed, and accountability expected. These shifts rarely make headlines, but they change performance outcomes dramatically.

When budgets chase novelty, they miss these pressure points. That is how organizations end up well-trained in the wrong areas while core work slows down.

Skill Investments Drift Away From Actual Job Demand

Once a budget cycle locks in, it tends to reinforce itself. Training programs get renewed. Hiring profiles stay stable. Skill gap analysis becomes a justification exercise rather than a discovery one.

Meanwhile, labor market insights keep evolving. Global job demand reflects new constraints, new operating models, and new expectations long before internal plans adjust. Without that external signal, organizations keep investing based on comfort and precedent, not urgency.

This is why hidden skill trends stay hidden. Not because the data is unavailable, but because it does not fit neatly into how skill decisions are usually made. Skill gap analysis that pulls in job demand insights forces a harder conversation. It shifts the focus from “what do we want to build” to “what is the market already forcing us to handle.”

Turn Skill Gap Analysis into a Forward Signal

Use global labor market insights to spot role stretch and capability pressure before it becomes attrition or rework.

How Global Job Demand Creates Skill Gaps Local Data Cannot Explain

One of the biggest blind spots in skill gap analysis comes from looking inward for too long. Internal data tells you how your organization works today. It does not tell you how the definition of “good” is shifting outside your walls. That shift shows up first in global job demand, and when you miss it, skill gaps feel sudden and confusing instead of gradual and predictable.

The Same Skill Is Valued Differently Depending On Where Work Happens

A skill is never just a skill. Its value depends on context. A role that looks identical on paper can carry very different expectations depending on the market it operates in.

In some regions, depth and precision matter most. In others, speed and adaptability are rewarded. Global job demand reflects this clearly. Job descriptions start emphasizing different outcomes even when the title stays the same. Local data flattens these differences, which is why skill gap analysis built only on internal benchmarks often underestimates what certain roles are being pushed to handle elsewhere.

Global Job Demand Signals Move Faster Than Internal Benchmarks

Most organizations update skill frameworks annually, sometimes even less often. Global job demand does not wait for that cadence. When operating models shift, whether due to regulation, automation, or cost pressure, job descriptions change almost immediately.

You see it in the language:

- broader ownership being expected earlier in careers,

- stronger decision-making requirements in roles that were previously execution-heavy,

- higher tolerance for ambiguity becoming a default expectation.

These changes spread across markets unevenly. By the time they show up in internal performance discussions, the market has already normalized them.

Local Skill Data Misses Cross-Market Pressure

Local hiring data is useful, but it is incomplete. It tells you what you are competing for today, not what you will be competing against tomorrow.

Global job demand shows where pressure is building. When the same role starts demanding more capability across multiple regions, that is not a coincidence. It is a signal that the skill bar is moving. Skill gap analysis that ignores this ends up preparing teams for yesterday’s version of the job while competitors quietly raise expectations.

Why Global Context Changes Skill Prioritization Decisions

This is where labor market insights become practical, not theoretical. Seeing how demand shifts across regions helps leaders make better trade-offs.

Instead of asking, “what skills should we add,” the question becomes:

- which skills are being stretched across markets,

- which roles are absorbing more responsibility globally,

- which expectations are becoming baseline rather than exceptional.

When skill gap analysis includes this perspective, it stops being reactive. It becomes a way to anticipate pressure before it shows up as missed deadlines, quality issues, or attrition. That is the difference between managing skills locally and understanding them in a global job demand context.

Skill Gap Reality Check

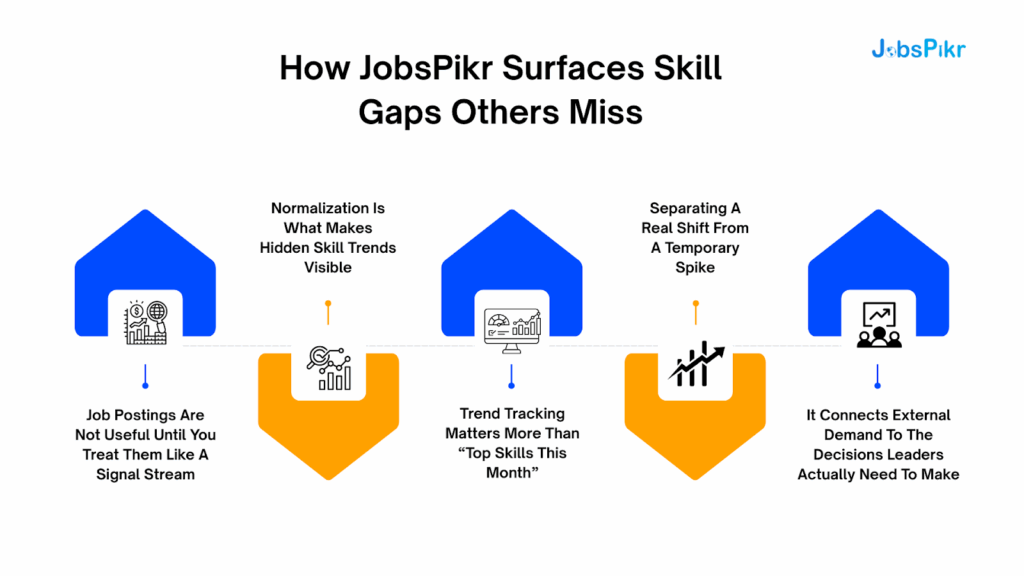

How JobsPikr Surfaces Skill Gaps Others Miss

Most teams do not lack data. They lack a way to tell what is signal and what is noise. Job postings look obvious until you actually try to use them for skill gap analysis. The language is inconsistent, the same role gets described ten different ways, and the “skills” are often buried inside responsibility statements. That is exactly where JobsPikr helps, it turns the mess into something you can trust and act on.

Job Postings Are Not Useful Until You Treat Them Like A Signal Stream

If you read job postings one by one, you end up with anecdotes. One hiring manager wrote a weird JD. One company stuffed buzzwords. None of that helps.

The only way job demand insights become meaningful is when you treat postings as a stream of signals and look for patterns that repeat across:

- many companies, not just one

- weeks and months, not a single snapshot

- role families and levels, not isolated titles

That is the difference between “we saw this skill once” and “this expectation is becoming normal.”

Normalization Is What Makes Hidden Skill Trends Visible

Here is the uncomfortable truth. Hidden skill trends are often not hidden because they are rare. They are hidden because everyone describes them differently.

A few examples you will recognize:

- one posting says “stakeholder management,” another says “cross-functional alignment”

- one says “operate independently,” another says “take ownership”

- one says “drive outcomes,” another says “end-to-end delivery”

If you do not normalize that language, your skill gap analysis becomes a word-count exercise. JobsPikr’s value is that it standardizes messy posting language so you can see the underlying capability shifts instead of chasing synonyms.

What Normalization Fixes In Practice

You stop getting distracted by wording and start seeing the real pattern. For example, “ownership” starts showing up earlier in careers across the market, or “decision-making under ambiguity” starts creeping into roles that used to be purely execution-focused.

Trend Tracking Matters More Than “Top Skills This Month”

A lot of tools can tell you what skills are mentioned today. That is not the hard part. The hard part is knowing whether it matters.

JobsPikr becomes useful when you can answer questions like:

- Is this skill demand rising steadily, or did it spike for two weeks?

- Is it spreading across industries, or stuck in one niche?

- Is it moving down-level, meaning juniors are now expected to handle it?

Those are labor market insights you can plan around. Without that time dimension, you end up reacting to noise.

Separating A Real Shift From A Temporary Spike

A real shift shows persistence and spread. It keeps showing up even when hiring volumes fluctuate, and it appears across multiple employers and markets. A spike burns out quickly or stays isolated.

It Connects External Demand To The Decisions Leaders Actually Need To Make

This is the part that gets missed. Even if you identify a gap, leaders still need to decide what to do with it.

Skill gap analysis becomes actionable when you can tie job demand to choices like:

- Do we hire for this, or can we reskill fast enough?

- Which roles are most exposed if we do nothing?

- Which capability gaps will slow execution first?

JobsPikr is not just “job data.” It is a way to translate global job demand into a clearer decision map, so you stop funding the loud gaps and start fixing the costly ones.

Turn Skill Gap Analysis into a Forward Signal

Use global labor market insights to spot role stretch and capability pressure before it becomes attrition or rework.

What Changes When Skill Gap Analysis Becomes An Intelligence System

When skill gap analysis is treated like a yearly exercise, it turns into paperwork. People debate definitions, argue about frameworks, and produce a report that is outdated before the next quarter starts. When it becomes an intelligence system, the outcome is different. You stop trying to “solve skills” in general and start making sharper calls about what to fix, when to fix it, and what happens if you do nothing.

You Stop Chasing Popular Skills And Start Prioritizing Pressure

A lot of organizations invest in skills because they sound future-proof. That is how budgets get pulled toward whatever is most visible, most vendor-supported, or most talked about.

An intelligence-driven approach forces a harder question. Where is demand pressure rising in a way that will hit execution. This is where job demand insights earn their keep. They show whether a capability is becoming normal across the market, not just trending on a list.

The practical shift is that skill gap analysis stops being a wish list. It becomes triage.

Hiring, Reskilling, And Redeployment Stop Competing With Each Other

In many companies, these three decisions operate in different rooms. Hiring teams push for more headcount. L&D pushes for training. Business leaders push to “just ship.” That is how you get fragmented action.

When skill gap analysis becomes talent intelligence, it gives you a shared view of the gap and its urgency. Then decisions become cleaner.

You Start Measuring The Right Outcome, Friction Reduction

Here is the part that changes culture. The success metric is no longer “how many people completed training.” It becomes “did the work get easier to execute.”

You can see the difference when:

- decisions land faster without escalation

- handoffs get cleaner

- rework drops

- teams stop relying on a few individuals as the safety net

This is why positioning matters. Skill gap analysis that stays inside HR reporting will never drive these outcomes. Skill gap analysis that sits on labor market intelligence can, because it ties skills to real job demand and real execution constraints.

The Biggest Shift: You Start Acting Earlier

Once you treat skill gaps as signals, you stop waiting for pain to become obvious. You catch expectation inflation early. You spot hidden skill trends while they are still manageable. You plan for global job demand shifts before they hit delivery.

That is what an intelligence system gives you. Not a better report. Better timing.

Skill Gap Reality Check

Skill Gaps Are Only Invisible When Leaders Stop Reading The Market

Skill gaps do not appear overnight. They build slowly, in small shifts that are easy to explain away. A role gets a little broader. A decision takes a little longer. A few people become the go-to fixers for everything. None of this feels urgent until it suddenly is.

The mistake most organizations make is treating skill gap analysis as a static diagnosis. Something you run, document, and revisit later. The market does not work that way. Global job demand keeps moving, expectations keep shifting, and roles keep absorbing new responsibilities whether internal frameworks acknowledge them or not.

When leaders start reading the market alongside their internal data, skill gaps stop feeling mysterious. They become visible earlier, easier to prioritize, and cheaper to address. That is the real shift. Not better labels. Not more training. But better timing and better judgment, grounded in labor market insights that reflect how work is changing.

Turn Skill Gap Analysis into a Forward Signal

Use global labor market insights to spot role stretch and capability pressure before it becomes attrition or rework.

FAQs

What Is Skill Gap Analysis And Why Is It Changing Now?

Skill gap analysis is supposed to answer a simple question: can our people do the work we are asking them to do. The reason it is changing is that the work itself is changing faster than the way most companies measure skills. Roles are picking up extra scope quietly, new tools get added, and expectations shift without anyone rewriting the job properly. So the old model, run an annual assessment and update a framework, keeps producing “gaps” that are technically true but not the ones slowing teams down right now.

How Are Hidden Skill Trends Different From Trending Skills?

Trending skills are the ones that sound clean in a slide. Hidden skill trends are the ones that show up in real job demand as awkward, messy expectations. You will not see “judgment” or “prioritization under pressure” listed as a skill very often. You will see “make trade-offs,” “own outcomes,” “manage ambiguity,” “work across stakeholders,” and “move fast without supervision.” That is the hidden part. The market is asking for them constantly, but organizations do not budget for them because they do not look like trainable modules.

Why Do Teams Feel Under-Skilled Even After Hiring?

Because the target moved. You hired for last year’s version of the role, and the role kept expanding after the person joined. Then everyone looks around and says, “we have the headcount, why does this still feel hard.” It feels hard because the job now includes more coordination, more decision-making, more risk handling, and more end-to-end ownership than the role was designed for. The gap is inside the role, not in the hiring pipeline.

How Does Global Job Demand Improve Skill Gap Analysis?

It stops you from using your own org as the only reference point. Global job demand shows when the market is normalizing a new expectation for a role. That helps you avoid two common mistakes. First, treating a local hiring issue like a universal skill shortage. Second, ignoring a real shift because it has not hit your performance reviews yet. In plain terms, global job demand helps you see what “good” is starting to mean elsewhere before your teams get compared against it.

How Does JobsPikr Support Skill Gap Analysis Beyond Job Data?

Raw postings are not insight. They are clutter. The value is in turning that clutter into something you can trust: patterns that hold across many employers, across time, and across markets. JobsPikr helps by making job demand comparable, so you can spot what is changing in roles without relying on gut feel or one-off examples. That is what makes skill gap analysis useful at MOFU: it shifts the conversation from “we think we need training” to “here’s what the market is demanding, here’s where we are exposed, and here’s what to do next.”