- Industries Feeling the Heat: Where Jobs Are Growing and Shrinking

- The Rise (and Risk) of Reshoring and Nearshoring in 2025

- Skilled Labor on the Move: Why Talent Mobility Looks Very Different in 2025

- What Trade Wars Mean for Labor Markets in the Next 5–10 Years

- Making Sense of Chaos: How JobsPikr Helps You Track Shifting Labor Markets

- FAQs

You’d think by now we’d be done talking about trade wars. But here we are, 2025, and tariffs are still messing with the global labor market in ways that aren’t always obvious but real.

Let’s get this straight: the days of predictable, globally distributed workforces are gone. That old playbook, hire cheap offshore, ship goods across borders, rinse and repeat—just doesn’t hold up anymore. Tariffs are back in style, and they’re not just about steel and soybeans this time.

We’re seeing a fresh wave of Trump-style tariff protectionism cropping up across the world. The U.S. slapped higher duties on Chinese electric vehicles and semiconductors in late 2024. China responded with its own set of global tariffs targeting Western agriculture and aerospace. Europe? They’ve started shielding their green tech industries. India? Pushing “Make in India” harder than ever, with import restrictions and homegrown manufacturing incentives.

So what does that mean for jobs? A lot, actually.

These moves are pushing companies to rethink not just where they sell, but where they build and hire. Labor demand is shifting. Some industries are reshoring. Others are just freezing hiring in tariff-hit zones. And this means a lot of sudden movement in once stable job markets.

If you’re in HR, workforce strategy, or labor market analysis, this isn’t background noise anymore; it’s front and center. Because tariffs in 2025 aren’t just a trade story. They’re a jobs story.

Industries Feeling the Heat: Where Jobs Are Growing and Shrinking

Not all sectors are hit the same way when tariffs go up. Some are getting hammered. Others are weirdly thriving. And if you’re trying to understand where hiring is headed—or why your recruitment pipeline just dried up overnight—following the tariff trail is a good place to start.

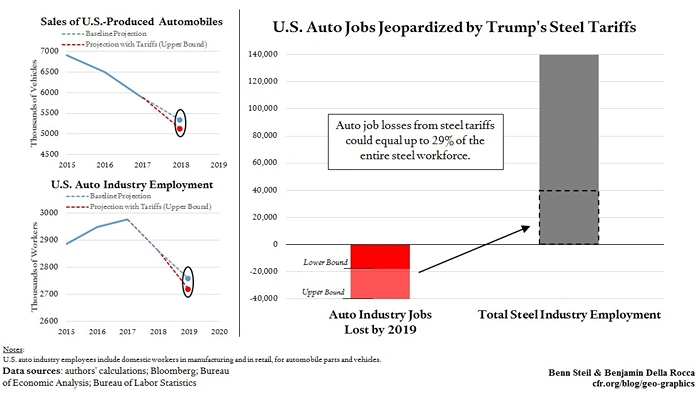

Image Source: Council on Foreign Relations

Manufacturing

This one’s obvious. U.S.-China tariffs have jacked up the cost of components across electronics, auto, and heavy machinery. In the U.S., some factories are ramping up domestic hiring to avoid imported parts altogether. But it’s not all good news—especially for plants that rely on a global supply chain. Jobs are being added in some towns and quietly cut in others. It’s uneven. And that makes workforce planning way harder than it used to be.

Logistics and Shipping

Global tariffs mean more rerouting, more customs headaches, and less predictability. Some ports are booming (hello, Mexico), while others are slowing to a crawl. Warehousing jobs are up in countries like India and Vietnam, where companies are trying to hedge against China-based supply risk. But in Europe and parts of North America, hiring in logistics is stalling as trade volumes flatten out under the weight of tariffs.

Technology

You might think software’s immune to all this, but think again. When data centers get slapped with import duties on chips and servers—or when countries start taxing cloud access from foreign vendors—it changes the game. Some tech companies are pulling back from cross-border hiring and going local-only. Others are shifting dev work to “neutral” countries that aren’t caught in tariff crossfire.

Green Energy and EVs

This sector is right at the center of the tariff storm. It’s heavily subsidized at home and tariffed abroad. If you’re a solar panel assembler in India or a lithium processor in Australia, you’re probably hiring. But if you’re in a U.S. company importing battery tech from China? Your staffing roadmap just got complicated.

Compliance and Trade Support Roles

Here’s the curveball. Jobs don’t just move—they morph. A tariff might not kill off a job category, but it could transform it. Think about compliance officers, customs specialists, or trade finance analysts. These roles are seeing spikes in demand because companies now have to navigate a maze of new duties and trade agreements. In short: more rules = more jobs for the people who understand them.

So yeah, global labor market trends in 2025 aren’t just about who’s hiring and who’s firing. They’re about why, and a lot of the “why” points straight back to tariffs.

The Rise (and Risk) of Reshoring and Nearshoring in 2025

Here’s what’s happening in boardrooms right now: companies are pulling out of long-held offshore operations and bringing jobs closer to home. That sounds like good news on paper—until you start peeling it back.

This shift isn’t entirely voluntary. It’s being forced by tariffs, political pressure, and just-in-case supply chain planning. Remember the rush to globalize in the early 2000s? 2025 is starting to look like its opposite. We’re seeing a surge in reshoring (bringing jobs back home) and nearshoring (moving them to geographically closer countries with fewer trade risks).

The U.S., for example, is seeing more manufacturing jobs returning, especially in areas like semiconductors, automotive parts, and defense tech. That’s partly because the Trump tariffs are still echoing through supply chains, but also because both political parties are now backing “economic patriotism.” And it’s not just about the U.S.—Germany is quietly rebuilding its domestic solar manufacturing base, and Japan is pulling production out of China faster than anyone expected.

But let’s not pretend it’s all smooth sailing. Reshoring brings its own problems:

- Labor shortages. In many developed countries, the people who used to do these jobs either moved on or aged out of the workforce. Now, companies are struggling to fill roles they’ve only just created.

- Higher costs. Labor isn’t cheap at home. That’s the whole reason offshoring happened in the first place. Now, companies are paying more to produce locally—something that might make hiring unsustainable in the long run unless automation closes the gap.

- Mismatch of skills. Shifting production closer doesn’t automatically mean the workforce is ready. In fact, many regions seeing reshored factories are dealing with a lack of talent that fits modern needs, especially in precision manufacturing or advanced robotics.

Now, take nearshoring—the in-between strategy. Mexico, Poland, Vietnam, and even Morocco are getting a ton of attention. Why? They’re close to major markets, not stuck in trade spats, and still relatively affordable. Nearshoring offers the flexibility of regional access with fewer tariff headaches. It’s no surprise that Mexico’s industrial hiring surged by 6.8% year-on-year in Q1 2025 (Statista). That’s not a small number.

But even nearshoring has risks. Political shifts, infrastructure limits, and talent bottlenecks can cause serious disruption. You’re basically betting on a new supply chain—one that hasn’t been stress-tested at a global scale.

So, the labor market story here isn’t just about jobs moving from China to America or India. It’s about the fragility of transition. Workforce planners are now being asked to map out hiring in countries that weren’t even part of the strategy five years ago.

If you’re responsible for hiring, training, or analyzing global labor trends in 2025, the message is simple: follow the tariffs, then follow the jobs.

Skilled Labor on the Move: Why Talent Mobility Looks Very Different in 2025

Talent mobility used to be about opportunity. Now, in 2025, it’s increasingly about escape or strategy. Skilled workers are on the move again, but this time the drivers are less about lifestyle and more about dodging the fallout of economic nationalism.

Let’s break this down.

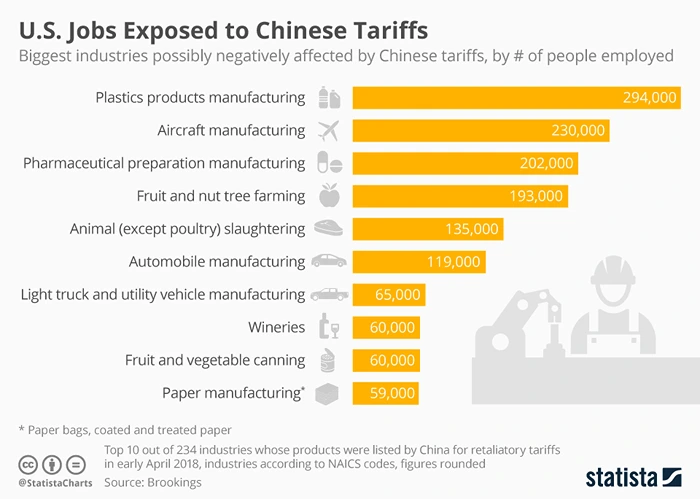

Global labor market trends in 2025 show a clear pattern: skilled professionals are moving to where demand is rising, and where tariffs aren’t choking industry growth. Engineers, logistics managers, compliance experts, and advanced manufacturing specialists are shifting across borders, but not necessarily in the direction we’ve come to expect.

For example, Europe is losing tech contractors to Southeast Asia—not because pay is better, but because cross-border taxation and supply-side delays are killing project velocity in places like Germany and France. Meanwhile, Singapore, Malaysia, and even the Philippines are gaining ground because they’re not caught in the U.S.-China tariff tug-of-war.

India is also emerging as a talent magnet, particularly in fields like data science, precision engineering, and clean energy manufacturing. Multinational companies are setting up alternative hubs there to avoid supply risk and lean on their talent pool. That’s translated into real jobs. According to Naukri’s Q1 2025 hiring report, India’s high-skill job openings in EV component manufacturing have grown 22% YoY, driven directly by global companies trying to offset tariff impact elsewhere.

In contrast, the U.S. is seeing a bit of a tug-of-war. On one hand, there’s an intentional push to hire domestically, especially in “critical” sectors like defense tech, semiconductors, and AI tooling. But on the other hand, visa policies haven’t kept up, so even companies that want to bring in foreign talent are hitting bottlenecks. That’s causing delays and increased labor costs at home, which ironically sends some of the same work right back overseas under the radar.

Image Source: Statista

And let’s not forget China. Its outbound skilled labor force is growing, especially in AI, blockchain, and renewable energy tech. With Western restrictions and global tariffs limiting Chinese companies’ global reach, many skilled professionals are now freelancing abroad, relocating to more neutral economies, or launching their own ventures in tariff-free zones like Dubai or Lagos.

What we’re seeing isn’t just a labor movement; it’s a talent strategy reshaped by policy. People are no longer just chasing salaries or titles. They’re chasing stability, access to growth industries, and distance from trade friction.

For workforce planners and HR leaders, this shift is hard to track and even harder to act on. Traditional talent maps are outdated. What used to be “tier-two” countries in global hiring are becoming top-tier choices, not because of cost, but because of consistency and freedom to operate.

In short, tariffs may be aimed at goods, but they’re pushing people around too.

What Trade Wars Mean for Labor Markets in the Next 5–10 Years

We’ve talked about what’s happening right now, but the bigger question is: where is all this heading? Trade wars don’t just blow over. They build habits. And those habits—where companies hire, where people move, where skills cluster—end up sticking around a lot longer than the tariffs themselves.

Let’s look at how the next decade might actually unfold if the current pace holds.

Tariffs Will Keep Redrawing the Global Labor Map

The old idea that you could build a supply chain that stretched from Shanghai to St. Louis without thinking twice? That’s done. Tariffs have made that kind of global sprawl too risky. What we’re seeing instead is a scramble to localize or regionalize—fast.

Labor markets are being reshaped by these decisions. Entire hiring hubs are popping up in places that weren’t even on the radar five years ago. And the reverse is happening too—factories, call centers, and tech campuses are going quiet in cities that used to thrive on offshore work.

If your business is global, you’ll need to treat workforce planning like chess. One move at a time, but always thinking five moves ahead.

Labor Costs Will Rise in “Safe” Zones

As more companies run toward the same so-called “safe” regions—Mexico, Vietnam, India—the cost of doing business there is going up. Fast.

There’s only so much skilled labor to go around in these hotspots, and when demand surges, so do wages. What was affordable three years ago suddenly isn’t. Companies that moved to avoid tariffs now find themselves squeezing margins to compete for talent.

This creates a weird paradox: the places that are safer from trade shocks are also becoming more expensive. So, what’s the play? Either get ahead of the wage wave by automating faster, or start investing in training before someone else snatches up your future workforce.

Workforce Planning Will Go from Operational to Strategic

Workforce planning has always been important—but now it’s becoming make-or-break. You can’t afford to wing it anymore.

This isn’t just about how many people to hire or where to post jobs. It’s about anticipating policy shifts, navigating global tariffs, and having a backup plan when your go-to hiring market suddenly becomes a political hot zone.

The smartest companies are already treating workforce planning as a strategy function, not just HR’s job. They’re building in-house labor economists. They’re tying talent plans directly to trade forecasts. This is the new reality—and it’s not optional.

Trade Barriers Will Create New Talent Gaps

Every time a tariff hits an industry, it pushes companies into unfamiliar territory. New locations. New materials. New technologies. And guess what? The local labor market isn’t always ready.

We’re going to see more talent gaps in unexpected places. You might need hydrogen mechanics in Kansas or AI compliance officers in Poland—and good luck finding them. These are jobs that didn’t exist a few years ago, and nobody’s training for them fast enough.

If governments and companies don’t act early—offering reskilling, incentives, or even just basic visibility into these new roles—those gaps will grow. And entire sectors could stall because they can’t hire fast enough.

Protectionism Will Accelerate Regional Talent Ecosystems

The big picture here is this: the world isn’t de-globalizing entirely, but it is splintering. Countries are doubling down on their own regions. They’re building mini-ecosystems—supply chains, markets, and labor pools that operate more independently.

So instead of one global labor market, we’re getting four or five regional ones. And each one is developing its own rules, incentives, and talent dynamics. That means someone in Brazil might find it easier to work in Argentina than in Canada. A Polish developer might get more gigs in the EU than in Silicon Valley.

For companies, this changes the game. You’ll need different workforce strategies for each region, and you’ll need to stop assuming talent moves as freely as it used to.

Making Sense of Chaos: How JobsPikr Helps You Track Shifting Labor Markets

If 2025 has made one thing clear, it’s this—there’s no “normal” in the global labor market anymore. Tariffs, trade friction, reshoring, nearshoring, rising costs, talent gaps—this isn’t just noise, it’s the new operating environment.

Here’s the truth: nobody’s got a crystal ball for the global labor market. But if you’re flying blind in 2025, you’re already behind.

Tariffs are hitting industries unevenly. Countries are reshuffling hiring priorities every quarter. Skilled talent is moving—sometimes fast, sometimes quietly. And what worked last year for sourcing roles in manufacturing, logistics, or tech? It might not work now.

This is where JobsPikr helps. We track real job postings from across the world. Daily. By industry, role, region, and skill. You can see where demand is picking up, where it’s cooling off, and how global shifts—like a new round of Trump tariffs or rising global tariffs in Asia—are playing out on the ground in hiring patterns.

It’s not magic. It’s just data that tells the truth.

If you’re planning headcount, building location strategies, or advising execs on where talent’s headed next, JobsPikr gives you the signal through all the noise. No guesswork. No lag.

Want a clearer view of the global labor market? Try JobsPikr today and make your next move a smarter one.

FAQs

1. How are global tariffs affecting the labor market in 2025?

They’re shifting everything. Tariffs mess with supply chains, which ends up messing with hiring. Jobs that used to sit in China or Eastern Europe are now showing up in Mexico, Vietnam, or staying domestic. Some roles vanish, others appear out of nowhere. It’s not about job losses alone—it’s about jobs being pushed around by trade policy.

2. What are the top global labor market trends in 2025?

Job markets are moving faster than ever. Companies are pulling operations closer, either back home or to nearby countries that are tariff-free. Talent’s moving too, especially in sectors hit by trade volatility. And roles in logistics, compliance, and advanced manufacturing are getting more important. The old idea of stable hiring zones? It’s gone.

3. Which industries are most impacted by global tariffs in 2025?

Manufacturing is right at the top, especially anything involving components or heavy materials. EVs and green tech are tangled in subsidy vs. tariff battles, too. Logistics feels the impact of rerouted trade flows. Even tech isn’t immune when hardware supply gets taxed or blocked. And all of this fuels hiring in support roles like customs, compliance, and local sourcing.

4. How can JobsPikr help companies navigate global labor market changes?

When hiring shifts because of trade policy, you need to see it before it’s old news. That’s what JobsPikr does—it tracks job postings worldwide in real time, so you can spot patterns early. If companies stop hiring in China and start hiring in India, you’ll know. If compliance jobs suddenly spike in one region, that tells you something. It’s not just job data, it’s an early warning for workforce strategy.